Oct 22, 2022

Your Saturday Briefing: Shifting Gears

, Bloomberg News

(Bloomberg) -- Hello there.

With little more than a week to go till their November meeting, Fed officials are looking ahead to another bumper rate hike. A 75-basis-point move is virtually guaranteed, and traders are looking at a similar or 50-point move in December. But with rates now approaching levels that could weigh on growth, policymakers are beginning to lay the groundwork for an eventual shift to smaller moves.

Hopes of an earlier end to the tightening cycle helped stocks stage their biggest weekly gain in four months. Add to that fears of missing out on the traditional winter rally — especially with elections approaching — some money managers are starting to look past the gloom of the past few months to position for a year-end rebound.

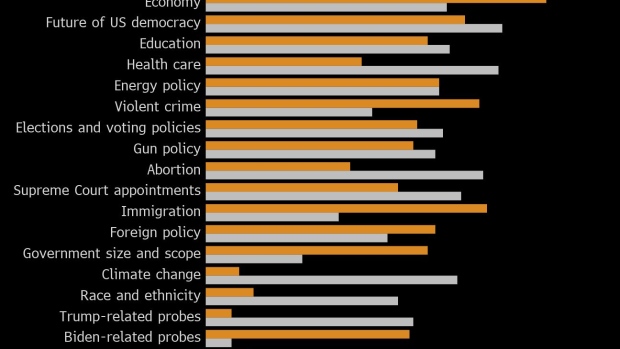

For now, inflation and fears of a recession are dominating the upcoming midterms, which will take place just days after the next Fed meeting. Erik Wasson talks to dozens of voters in Pennsylvania and New Jersey, where the economy has become the make-or-break issue in toss-up races.

Unfortunately for the Democrats, several opinion polls show voters don’t think they’re focusing on the most important questions and have instead been centering their campaign on other issues, notably abortion. That could cost them dearly next month, says Ramesh Ponnuru in Bloomberg Opinion.

Speaking of races, the UK is having one for its third prime minister in four months. After six weeks that left markets reeling, Liz Truss resigned and a familiar cast of characters is vying to replace her. Penny Mordaunt was the first to throw her hat in the ring, Rishi Sunak has an early lead and Boris Johnson’s camp claims he has already met the threshold of support from Conservative lawmakers to get to the next stage.

No matter who wins, the next PM will inherit an economy damned for the immediate future by rising borrowing costs, crippling energy bills, high taxes and no strategy about how to revive growth.

Meanwhile, spare a thought for the employees at Twitter. With Elon Musk’s deal to buy the company set to close in a week, workers are bracing for layoffs after reports that the billionaire is planning to slash up 75% of staff. It’s especially ironic, given the company has been sending workers tips on self care and balance for national emotional wellness month. Even the Biden administration isn’t giving the company a break. Bloomberg reported that officials are discussing whether to subject some of Musk’s ventures — including the Twitter acquisition — to national security reviews.

If you’re looking to get away from it all, consider Austin, Texas, which is hosting the Formula One Grand Prix this weekend. Max Verstappen already has enough points to clinch the title this year, but there’s bound to be enough thrills on the track. You’ll have plenty of post-race entertainment to pick from too, including concerts by Green Day and Ed Sheeran as well as a set from DJ Diesel AKA Shaquille O’Neal.

And while the NBA season tipped off this week, one city in particular is missing out. Seattle has a basketball arena and rabid fans, produces its share of talent (this year’s top draft pick hails from the city) and is home to numerous millionaires and billionaires who could be potential team owners. All that’s missing is its own team.

And finally, the Fed appears to be playing a “dangerous” one with its consecutive 75-basis-point hikes, says Kristina Hooper, chief global market strategist at Invesco. Catch her on the What Goes Up podcast.

Enjoy the rest of your Saturday, and we’ll be back tomorrow with a look-ahead to the coming week.

©2022 Bloomberg L.P.