Nov 12, 2023

A Big Bond Rally Needs a Recession With Fed Wary of ‘Head Fakes’

, Bloomberg News

(Bloomberg) -- Up and down Wall Street, it’s becoming increasingly clear that the US bond market won’t see a sustained rally unless the economy surprises even the Federal Reserve by falling into a deep recession.

Over the past three years, Treasuries staged several false rebounds from the deepest rout in decades, only to reverse course, sending yields higher again and burning those who had bet big on the swing.

Another rally raced through the market at the start of this month, after Fed Chair Jerome Powell held interest rates steady and signaled the central bank’s interest-rate increases may finally be done.

But the economy’s continued resilience has strengthened the odds that the central bank will be able to steer the US into a rare soft landing. Powell told reporters this month that the central bank isn’t expecting a recession — and forecasters are predicting that economic growth will continue, albeit at a slower pace, through next year.

The upshot: The type of bond rally that usually breaks out once the Fed starts slashing rates to jumpstart growth will have to wait.

“We have to see pretty severe deterioration in financial conditions to see rate cuts,” said Kathryn Kaminski at AlphaSimplex Group, whose fund made a nearly 36% return last year. “Inflation is still an issue. Rates could be higher for longer. So there’s still a really good chance that we are going to see a lot of volatility instead of a new trend.”

Fed officials have repeatedly warned markets that they’re in no rush to cut rates, with the priority squarely on continuing to pull down inflation. That will be a key focus on Tuesday, when economists expect the Labor Department to report that the growth in its consumer-price index slowed to an annual rate of 3.3% in October from 3.7% in September.

On Thursday, however, Powell said that “inflation has given us a few head fakes” and the Fed “will continue to move carefully,” mindful of the “risk of being misled by a few good months of data.”

That tone prompted traders to push off expectations for the first likely Fed cut in 2024 to July from June and nudged the policy-sensitive two-year Treasury yield back above 5%.

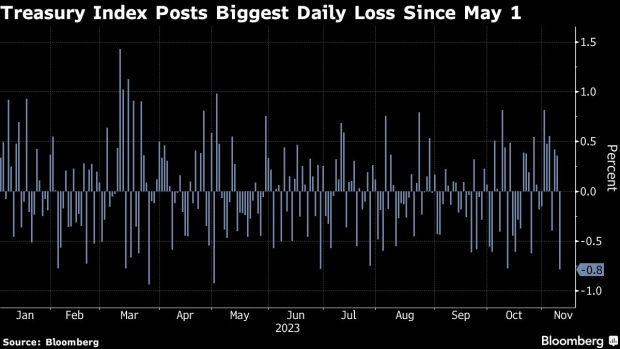

While yields remain down from last month’s peaks, the market continues to be volatile, as evidenced by the swift selloff that erupted Thursday after there was unusually weak demand at the Treasury 30-year bond auction. And a broad index of Treasuries was down 1.3% this year through Nov. 9, after losing an unprecedented 12.5% last year and 2.3% in 2021.

Also undermining sentiment are ongoing concerns over the US’s finances and subsequent need for new debt. Thursday witnessed one of the worst auctions of 30-year bonds in a decade and Friday ended with a warning from Moody’s Investors Service that it’s inclined to downgrade the nation amid wider budget deficits. The risk of a government shutdown as soon as this week also looms although may be easing.

A cyberattack on Industrial & Commercial Bank of China Ltd. created tensions too.

While the Fed next year may start easing monetary policy to make it less restrictive, it’s unlikely to pivot toward lowering rates significantly unless the job market shows signs of deteriorating and inflation nears its 2% target. While bond bulls welcomed signs of US job growth slowing, with the unemployment rate in October rising to an almost two-year high of 3.9%, it remains strong by historical standards.

Of course, the economy could keep slowing under the weight of the Fed’s rate hikes or be hit by an unanticipated shock. One is the potentially fallout of a US government shutdown, since the current federal funding will lapse on Nov. 18 if Congress doesn’t agree on a new plan.

What Bloomberg’s Strategists Say...

“Overall, Treasuries will continue to face more downside than upside risk, especially as the chance of a near-term recession has receded.”

— Simon White, macro strategist

Click here for the full report

But traders anticipating a Fed pivot should be wary, “because there’s been numerous head fakes over the past 18 months,” said George Catrambone, head of fixed income, DWS Americas.

Swaps contracts tied to Fed policy meetings are penciling in that the central bank’s effective rate — which is an average of where funds trade each day in the market — will fall to around 4.6% by the end of next year from 5.33% now. That’s a slightly steeper drop than the the half-point decrease Fed officials projected in their most recently quarterly forecasts.

“The market prices things on a probability-weighted basis,” Kelsey Berro, fixed-income portfolio manager at JPMorgan Asset Management, told Bloomberg Television. “There may be a 50%, 60% probability that the Fed can stay on hold all year. There is also a probability you get a recession,” and “in a recession the Fed cuts very quickly.”

What to Watch

- Economic data:

- Nov. 13: New York Fed 1-yr inflation expectations; monthly budget statement

- Nov. 14: NFIB small business optimism; real average weekly earnings; Consumer price index

- Nov. 15: MBA mortgage applications; retail sales; Producer price index; empire manufacturing; business inventories

- Nov. 16: Import and export price index; initial jobless claims; Kansas City Fed manufacturing index; NAHB housing index; TIC flows

- Nov. 17: Building permits; housing starts; Kansas City Fed services index

- Fed calendar

- Nov. 14: Chicago Fed President Austan Goolsbee; Fed’s Philip Jefferson

- Nov. 16: Cleveland Fed President Loretta Mester; NY Fed’s John Williams; Fed Vice Chair for Supervision Michael Barr

- Nov. 17: Boston Fed President Susan Collins; Goolsbee; San Francisco Fed President Mary Daly

- Auction calendar:

- Nov. 13: 13-, 26-week bills

- Nov. 14: 42-day cash management bills

- Nov. 15: 17-week bills

- Nov. 16: 4-, 8-week bills

©2023 Bloomberg L.P.