Apr 9, 2024

AI Boom Sends Korean Power Equipment Producers’ Shares Surging

, Bloomberg News

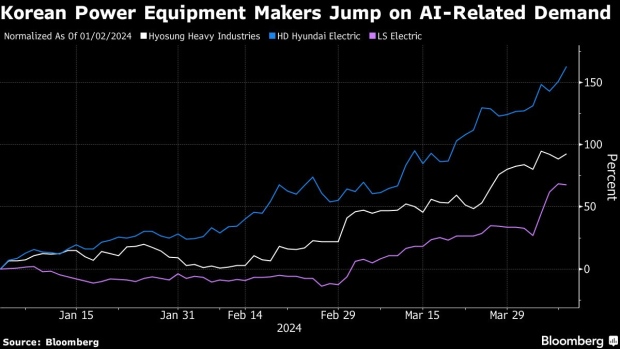

(Bloomberg) -- Shares of South Korean electrical equipment makers are among the biggest winners in the country’s stock market this year, driven by an anticipated surge in power demand from artificial intelligence and data centers in the US.

HD Hyundai Electric Co., which manufactures power transformers, switchgear and generators, has risen nearly 160% this year, making it the top performer in the benchmark Kospi. Hyosung Heavy Industries Corp. has almost doubled, and LS Electric Co. jumped nearly 70% during the same period.

Their gains show the industry stands to be a key beneficiary of the soaring power needs for AI applications, data centers and other digital services. Equipment demand from the US is expected to be particularly acute, given its aging and inefficient power grids.

“Asia’s electricity equipment is a huge theme due to AI,” said Jae Lee, chief investment officer at Timefolio Asset Management SG Pvt. in Singapore. “Electricity is in big shortage and the US electricity infrastructure is too old.”

The industry is also seeing sales tied to orders from new production facilities being built in the US by other Korean conglomerates, including Samsung Electronics Co., Hyundai Motor Co. and LG Energy Solution Ltd.

The Korean makers of electricity transformers and other related equipment have gone from having almost no overseas exposure to about 60% to 70% of their revenues now coming from the US, Lee said. Their “sharply” improving margin underscores the change, he said.

“There is enormous demand to upgrade US electricity infrastructure and US clients are placing massive orders to Korean power-equipment firms,” Lee said.

US manufacturers, such as General Electric Co. and ABB Ltd, have been dominant in their market, but booming power demand also has contributed to a shortage of equipment in the country. That’s pushed the prices higher and created a backlog in orders that has benefited the Korean producers, according to Yoon Joonwon, a fund manager at DS Asset Management Co.

“In the era of AI, power shortage is seen as part of a structural supercycle,” Yoon said. “While the stocks are looking somewhat overheated in the short term, it’s right to bet on these companies, given that they are still undervalued.”

©2024 Bloomberg L.P.