Feb 28, 2023

Airbnb’s $24 Billion Gain Fails to Dissuade Bears

, Bloomberg News

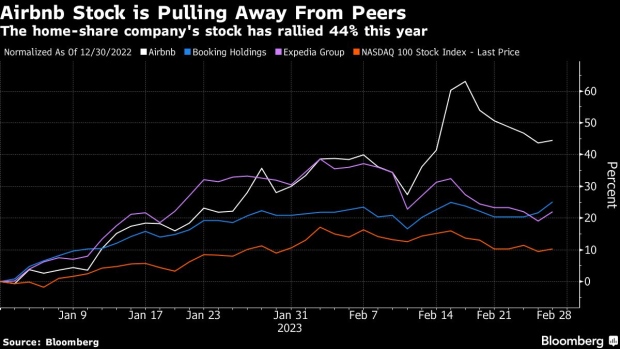

(Bloomberg) -- With earnings and its stock in the ascent, Airbnb Inc. has made a stellar start to 2023. Yet not all analysts are buying it.

The home-rental company’s five sell or equivalent recommendations are the most of any Nasdaq 100 company after Intel Corp., Tesla Inc. and Cognizant Technology Solutions Corp. What’s more, the percentage of sell ratings is the highest in more than two years at almost 12%, according to data compiled by Bloomberg.

The worry for bears is not so much the company’s performance but its frothy valuation. Results this month showed travel demand running high and profitability improving, stoking a rally in its shares, which have surged 47% this year, adding about $26 billion in market value. That’s pushed the valuation relative to a measure of earnings even further above peers such as Booking Holdings Inc. and Expedia Group Inc.

“I worry about how much more the stock can rally,” said Matt Maley, chief market strategist at Miller Tabak + Co.

That view is shared by Morgan Stanley analyst Brian Nowak, who this month retained an underweight stance on the shares, even after boosting his price target by 25% to reflect increased earnings estimates. The stock is “already priced for even faster growth,” he wrote in a report.

According to Miller Tabak’s Maley, Airbnb trades more like a tech stock than its closest peers, which might partly explain its outperformance given this year’s market-beating rally in the Nasdaq 100.

The same is probably true of the stock’s valuation, with Airbnb trading at an enterprise value to estimated earnings before interest, taxes, depreciation and amortization ratio of 21 times, towering over Booking at 13 times and Expedia at 7 times, Bloomberg data show.

“I’m not so sure that it deserves to trade that way,” Maley said.

To be sure, the shares aren’t as expensive as they once were, coming off the back of a 49% slump in 2022. Having been a major beneficiary of the work and lifestyle changes wrought by the pandemic, Airbnb is starting to see some of the trends it gained from — such as people renting large rural homes for weeks or months at a time — reverse and travelers opt for shorter stays in big cities and more international destinations.

And while the company has been driving profitability by cutting costs, analysts are concerned that a slowdown in the number of nights booked and headwinds on average daily rates may pressure sales growth and margins this year.

Rates “across the industry, whether it’s hotels, alternative accommodations, are extremely elevated from pre-Covid levels,” said Nicholas Jones, an analyst at JMP Securities who has a market perform rating on the stock.

According to the average of estimates compiled by Bloomberg, revenue growth is projected to fall to 14% in 2023, from 40% last year.

Thomas Martin, senior portfolio manager at Globalt Investments, says the shares have “come a bit far a bit fast.”

“If you were not in the stock, you’d look for an entry point after it corrects,” he said.

Tech Chart of the Day

Tesla shares rose as much as 1.7% on Tuesday, poised to extend gains as the electric-car maker closes in on the market capitalization of Berkshire Hathaway Inc. — the fifth most-valuable company in the S&P 500 Index. The stock has more than doubled from its intraday low on Jan. 6 helping Chief Executive Officer Elon Musk to reclaim his spot as the world’s richest person, after briefly losing the title to France’s Bernard Arnault.

Tesla’s Ripping Rally Puts It Back on Track for Top Five Ranking

Top Tech Stories

- Zoom Video Communications Inc. gained in late trading after giving an upbeat profit forecast for the current period, signaling that a cost-cutting push is helping offset a sales slowdown.

- Apple Inc.’s Chinese suppliers are likely to move capacity out of the country far faster than many observers anticipate to pre-empt fallout from escalating Beijing-Washington tensions, according to one of the US company’s most important partners.

- The chatbot battle is heating up, and Mark Zuckerberg is making it clear that Meta Platforms Inc. is focusing on artificial intelligence-powered tools, too.

- The $15 billion buyout of Toshiba Corp. is increasingly looking like a purely Japanese affair as most international buyout firms are poised to drop from the deal, according to people familiar with the matter.

- Chinese media regulators are studying measures to curb addiction among youths to short videos, the format popularized by tech giants from ByteDance Ltd. to Tencent Holdings Ltd.

- The semiconductor industry will return to an exponential growth path next year despite lingering inflationary and geopolitical uncertainties, according to machinery maker Tokyo Electron Ltd.

- Goldman Sachs Group Inc. became the latest broker to downgrade Nintendo Co. as the market awaits the successor to its aging Switch game console.

--With assistance from Tom Contiliano.

(Updates to market open.)

©2023 Bloomberg L.P.