Feb 26, 2024

Airline Stocks Get Left Behind in Europe’s Run to a Record High

, Bloomberg News

(Bloomberg) -- The record-setting rise in European equities masks one part of the market that’s nowhere near recovering from the Covid-induced collapse four years ago: airlines. Investors are skeptical of turning bullish on the region’s cheapest sector due to its erratic earnings profile.

While the Stoxx Europe 600 Index has surged nearly 80% since a post-Covid low in March 2020 and hit an all-time high last week, a gauge tracking regional airlines is up just over 23%. The carriers have also underperformed the broader travel and leisure index — which includes hotels, gaming stocks and online booking platforms, businesses that have seen a relatively bigger benefit from a revival in travel demand.

The handicap for airlines is intense competition and volatile fuel prices, even as their earnings have almost returned to pre-pandemic levels. While analysts remain optimistic and have upgraded profit projections further, fund managers said the unpredictable outlook for oil renders forecasts unreliable at best. Airlines are more sensitive to energy price shocks than other travel stocks as they face an immediate impact on fuel costs.

“Airlines are ruthlessly competitive,” said David Cohen, a portfolio manager at Boston Partners. “It’s easy to add capacity and they’re very sensitive to energy prices. Profitability can look quite good if energy prices are stable, but then you get a 20% rally in oil and profits dry up. We haven’t owned airlines for many many years and I’m not looking to get back into them.”

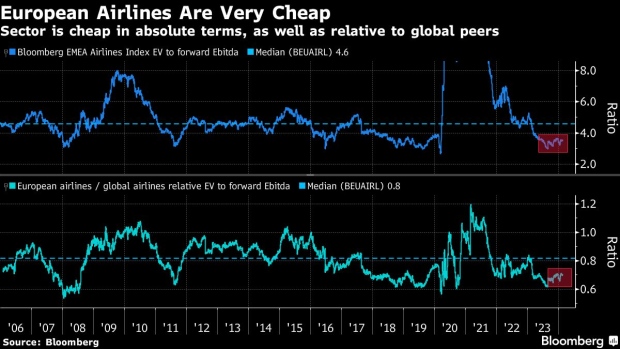

Judged on valuation, the six airlines in the index — Ryanair Holdings Plc, Deutsche Lufthansa AG, easyJet Plc, British Airways-parent IAG Group SA, Air France-KLM and Wizz Air Holdings Plc — should be investor favorites. Their 12-month forward price-to-earnings ratio of 6 is much lower than the Stoxx 600’s valuation of more than 13. They’re also the cheapest group of stocks among all the European sectors, according to data compiled by Bloomberg.

Moreover, figures from the International Air Transport Association (IATA) showed that a consistent recovery in passenger traffic through 2023 has brought them close to matching pre-pandemic demand.

The bounce back in travel has contributed to European airlines facing some capacity headwinds headed into the busiest travel season of the year. That’s because the likes of Wizz Air and Lufthansa have to contend with maintenance of some Airbus A320 models that have engine issues, while Ryanair is getting fewer aircraft than planned because of manufacturing problems at Boeing Co., the supplier of all its jets.

Analysts said pricing power isn’t a problem. Most airlines should be able to charge premium fares as the economy remains broadly stable in the first half of 2024, according to the research team at UBS Group AG. Their optimism toward the sector shows in average potential share-price gains of more than 30%, among analysts tracked by Bloomberg, with returns as high as 44% projected for Air France-KLM — the cheapest in the group.

A closer look shows that some airlines are regarded more highly than others. Most analysts prefer the likes of Ryanair and Wizz Air, as their short-haul flights are less vulnerable to any turbulence in the global economy. Sanford C. Bernstein analysts Alex Irving and Tobias Fromme — who have outperform views on Ryanair, Wizz Air, Air France-KLM and IAG — said this month that fares were rising for flying within Europe, while declining at long-haul carriers from a much higher base.

Similarly, Bank of America Corp. analyst Muneeba Kayani favors short-haul carrier easyJet due to a lower cost base and stronger margins than rivals. More broadly, the team at Morgan Stanley said that the ratio of enterprise value to Ebitda for the sector is up to 58% cheaper compared with history, a bullish sign as demand stays resilient.

But none of that is enticing enough for Robert Alster, chief investment officer at Close Asset Management. He said online booking providers are a better way to play the recovery in travel demand as they also capitalize on the boom in technology stocks.

“People will carry on going on holiday, but I just feel it’s almost like a tired investment story,” Alster said in an interview. “If the rate cycle plays out as we are thinking, then it’s going to be other consumer group-related stocks that are going to benefit.”

--With assistance from Sujata Rao, Lisa Pham and Benedikt Kammel.

©2024 Bloomberg L.P.