May 31, 2022

Alibaba, JD.com jump on easing COVID curbs, economic data

, Bloomberg News

China Reopening Stocks Favored, UBS Global Wealth Management Says

U.S.-listed Chinese stocks jumped to wipe out their monthly losses, as easing in lockdown measures in major cities and better-than-expected economic data reassured investors.

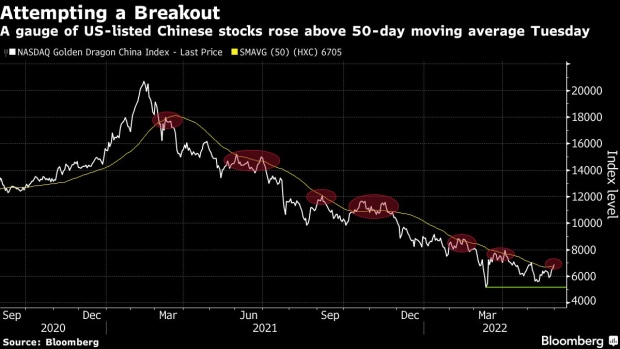

With a 3.7 per cent climb on Tuesday, the Nasdaq Golden Dragon China Index capped its first monthly gain of 2.6 per cent since October, snapping a six-month losing streak. Shares of e-commerce giant Alibaba Group Holding Ltd. rose 2.8 per cent, while large-cap Chinese internet stocks JD.com Inc. advanced 4.6 per cent and Baidu Inc. inched up 0.9 per cent. Electric carmakers also rose, with Nio Inc. up 5.0 per cent after China announced a 50 per cent cut in the purchase tax for low-emission passenger vehicles.

With daily coronavirus cases falling below 100 for the first time since March, China is letting up some restriction measures. Shanghai will resume public transportation from Wednesday after being in a lockdown for two months, and Beijing is allowing some shopping centers to reopen.

The news flow out of China “remains bullish”, according to Adam Crisafulli, the founder of Vial Knowledge. “While ‘zero-tolerance’ will keep China lockdown risks elevated, it seems like the government will be forced to subtly soften its adherence to this policy given the economic destruction of the last few months,” he wrote in a note.

While China’s factory and services sectors are still in a contraction, official manufacturing and non-manufacturing purchasing managers indexes improved in May, suggesting the worst of the current economic fallout may be nearing an end. Both metrics beat consensus estimates in a Bloomberg survey.

“The improvement of China PMIs echoed the bottoming out of high-frequency macro data since mid-May, suggesting that the worst of the COVID disruption on China’s growth could have passed,” said Jeffrey Zhang, a Hong Kong-based emerging market strategist at Credit Agricole SA. “Better sentiment in the manufacturing sector should partially ease concerns of China’s logistics and production disruption, and bode well for the recovery of its value-chain partners.”

While the Nasdaq Golden Dragon Index is still down 23 per cent year to date, its recent rebound led the gauge to climb above its 50-day moving average on Tuesday. The group is now facing a key test whether the rally could sustain and meaningfully top that key resistance level.

What may help is the optimism returning to beaten-down Chinese stocks, with asset manager Amundi among the latest to turn more bullish on the group. Better-than-expected earnings from heavyweights including Alibaba and Pinduoduo Inc. are also propping up the sector, as companies trim losses and become more disciplined, according to Jian Shi Cortesi, a portfolio manager at GAM Investment Management.

“There were too many factors lumped together, resulting in extreme bearishness toward China equities, in particular, these ADRs,” she said. “If the bad news just stops, the market can rally.”