Oct 2, 2020

Amazon-backed Ecobee said in merger talks with Canaccord SPAC

, Bloomberg News

Ecobee Inc., a home automation startup backed by the Amazon Alexa Fund, is in talks to go public through a merger with blank-check firm Canaccord Genuity Growth II Corp., according to people with knowledge of the matter.

A transaction is set to value the combined company at about US$490 million, including debt, said one of the people. The Canaccord special purpose acquisition company has discussed raising about US$50 million in new equity to support the deal, though terms could still change, the person added. As with all deals that haven’t been finalized, talks could fall apart.

Representatives for Ecobee declined to comment. Canaccord Genuity Growth did not immediately respond to a request for comment.

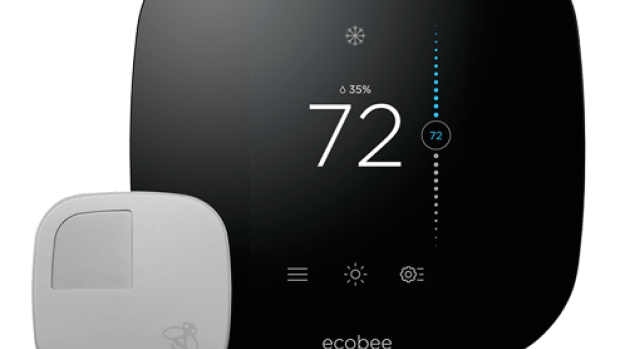

Ecobee, led by founder and Chief Executive Officer Stuart Lombard, makes a so-called smart thermostat that competes against Google’s Nest product. Ecobee customers across North America have saved more than 10.4 terawatt-hours of energy, which is the annual equivalent of the energy required to run all the homes in Las Vegas for a year, the company’s website says.

Toronto-based Ecobee also makes home security products including smart cameras and sensors, as well as air filters. The company in 2018 said it had raised more than $200 million (US$150 million) from investors including Energy Impact Partners, Caisse de depot et placement du Quebec, Australia’s AGL Energy Ltd. and Business Development Bank of Canada. Other investors include Thomvest Ventures Inc., which invests on behalf of billionaire Peter J. Thomson, and Toronto-based Relay Ventures.

The Canaccord SPAC, led by chairman and CEO Michael Shuh, raised $101 million in a March 2019 initial public offering. In its prospectus, the company said it would search for target businesses that are involved in cannabis production or distribution or related sectors, but reiterated it’s not limited to a particular industry or geographic region.