May 7, 2021

Arabica Coffee Set for Longest Run of Weekly Gains Since 2019

, Bloomberg News

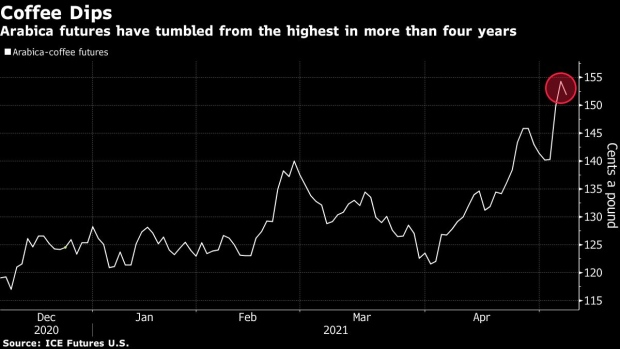

(Bloomberg) -- Arabica coffee is on track for its longest run of weekly gains since 2019 amid persistent dry weather in top producer Brazil and a broader rally across commodities.

Coffee retreated Friday from this week’s four-year high but is set for its biggest weekly gain since July. Arabica futures have rallied by about 25% since the beginning of April on expectations of lower 2021-22 crop in Brazil due to drought. Meanwhile, as major consuming economies start to reopen, demand is set to rise.

At the same time, export disruptions in No.2 exporter Colombia and a strengthening Brazilian real earlier this week also boosted prices. The rally has pushed coffee’s 14-day relative-strength index into overbought territory.

“The outlook for Brazil’s 2021/22 Arabica crop continues to deteriorate with current dry weather, so a near-term pullback may present a fresh opportunity to approach the long side of the market,” The Hightower report said.

Arabica coffee for July delivery fell as much as 2.1% to $1.5105 a pound in New York, the most in a week. However, prices are headed for a weekly gain of about 8%. Robusta was steady in London.

In other soft commodities, cocoa futures were steady in New York and London. Both sugar and raw sugar retreated.

©2021 Bloomberg L.P.