Nov 29, 2019

As Bitcoin Sell-Off Abates, Technicals Point to $8,000 Threshold

, Bloomberg News

(Bloomberg) -- Bitcoin bulls have at least one technical indicator to be thankful for.

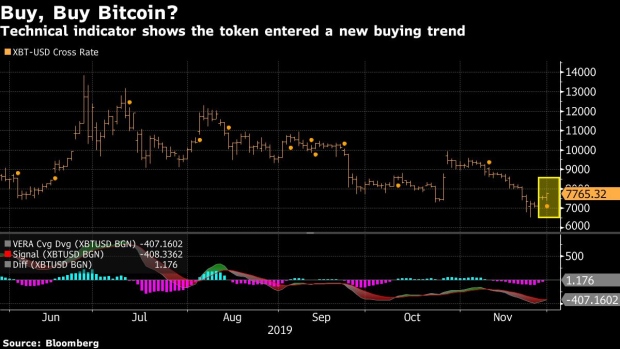

Based on the GTI Vera Convergence Divergence Indicator, which measures up and down shifts, Bitcoin entered a new buying trend, potentially signaling that it’s primed to retake the upper end of its trading range around $8,000. That’s a welcome sign for bulls who saw Bitcoin’s price drop more than 15% in November.

November’s been volatile for cryptocurrencies, which traded lower for much of the month after China took steps to crack down on digital asset trading. The latest clampdown has already claimed its first casualties: at least five local exchanges have halted operations or announced they’d stop serving domestic users this month, Bloomberg News reported.

“It appears we have seen some profit taking on short positions, which has lifted prices,” said Craig Erlam, senior market analyst at Oanda. But, “there’s obviously been a lot of bearish sentiment recently and there’s nothing in the bounce that suggests a shift to me.”

Bitcoin gained as much as 4% on Friday to trade around $7,770 at 11:40 a.m. in New York. A rise to $8,000 would indicate a gain of about 3% from current levels. Peer coins, including Litecoin and XRP also gained, up as much as 4.5% and 2.8%, respectively.

--With assistance from Kenneth Sexton (Global Data).

To contact the reporter on this story: Vildana Hajric in New York at vhajric1@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Dave Liedtka, Randall Jensen

©2019 Bloomberg L.P.