Jan 9, 2024

AT1-Like Market for Niche Insurance Notes Is Coming Back to Life With AXA Debut

, Bloomberg News

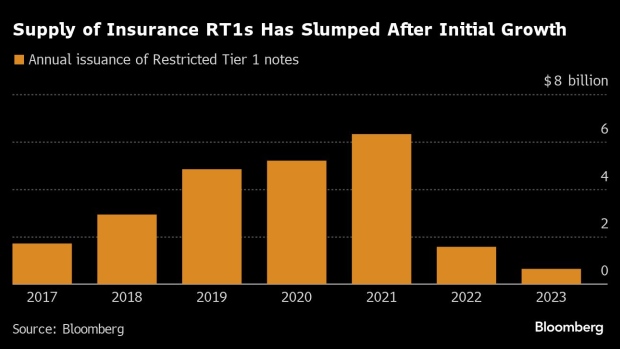

(Bloomberg) -- The market for Restricted Tier 1 notes — the insurance industry’s equivalent of AT1s that hadn’t seen a single euro offering since the summer of 2021 — is roaring back with a record deal from AXA SA. More may follow as a deadline for older types of note looms.

The French insurer sold €1.5 billion ($1.64 billion) of RT1 notes, for which it received orders of almost €8 billion, according to a person familiar with the matter, who asked not to be identified because they’re not authorized to speak about it. AXA’s debut RT1 deal marks the biggest ever sale of a single tranche of the securities, based on data compiled by Bloomberg.

The offering portends the end of a fallow period for RT1s. The market grew consistently after the creation of the securities in 2017, but issuance in other currencies has been sparse for the past couple of years because of high interest rates and after sentiment was hit by the $17 billion wipeout of Credit Suisse AT1s.

An end-2025 deadline that will put at least €14 billion of older notes out of compliance with post-financial crisis regulations may spur more sales as insurers seek to meet capital requirements.

“The end of the grandfathering period will create some additional traction for some of the big issuers to sell RT1 but it will depend on the cost,” said Marcos Alvarez, global head of insurance at Morningstar DBRS, referring to a 10-year grace period that insurers were given to deal with junior bonds. “Issuers and investors got scared after the Credit Suisse debacle. Now some issuers are thinking about RT1s again.”

AXA is one of the insurers most reliant on so-called grandfathered notes, with at least €2.3 billion of old-school notes still outstanding, based on data compiled by Bloomberg.

Representatives at AXA did not respond to requests for comment.

The rules that insurers need to comply with, called Solvency II, came into force in 2016 with the aim of making insurance companies more resilient after the global financial crisis. Solvency II dictates capital requirements for insurers, and spurred the creation of RT1 notes as a capital buffer that works in a similar way to AT1 bonds for banks.

RT1s are perpetual, interest payments can be canceled and holders have to swallow losses through principal writedowns or conversion to equity once regulatory capital falls below a threshold — typically below 75% for the Solvency capital requirement ratio.

AXA last reported a Solvency II ratio of 230% at the end of September 2023. It was this strong level that allowed the insurer to redeem a grandfathered bond last summer without refinancing it, CreditSights Inc analysts Martina Seydoux and Larissa Knepper wrote when the company reported results.

European insurers have been actively reducing their exposure to old-school notes over the past year. Some companies issued eligible types of capital while buying back back billions of dollars worth of old notes, in some cases causing a jump in price on the secondary market.

Read: As $23 Billion Deadline Nears, Insurers Buy Back Junior Debt

Last week, Allianz SE, Europe’s largest insurer and biggest issuer of RT1 notes, issued a new tier 2 instrument while offering to buy part or all of a €1.5 billion issue: the largest remaining note covered by grandfathering rules. Tier 2 notes sit above RT1s in insurers’ capital stacks, and have been more popular during the period of high rates and fragile sentiment.

AXA’s deal priced with a coupon of 6.375%, lower than initial price discussions amid the high demand, the person familiar said. AXA held calls with investors on Monday, ahead of the offering’s launch, they said. Bonds used to determine a ballpark price level included RT1s from other insurers and AT1s from large French banks.

“Having a big name like AXA has a positive impact. This market is not as liquid and deep compared to banks’ AT1 but we already have some big names participating and another one will help,” said Morningstar’s Alvarez.

(Updates bond terms in third, 13th paragraphs.)

©2024 Bloomberg L.P.