Nov 6, 2022

Aussie Slumps as China Vows to Stick With Covid-Zero Strategy

, Bloomberg News

(Bloomberg) -- The dollar extended losses on Monday as appetite for risk assets remained strong ahead of fresh US inflation data and the results of midterm elections.

A Bloomberg gauge of the US currency fell 0.4% in New York after rising as much as 0.5% earlier as the risk-on mood hurt demand for the safety of the greenback. Most emerging-market currencies were up on the day, while the pound, Swiss franc and euro led the advance among Group-of-10 currencies.

Treasuries were also choppy, erasing an earlier gain to edge lower amid a slate of corporate bond issuance. US yields surged last week on stronger-than-expected labor data and Federal Reserve Chair Jerome Powell’s remarks that monetary-policy tightening will continue as long as inflation stays elevated.

“News that would have been very dollar positive a few months ago now seems to have marginal impact,” Steve Englander, Standard Chartered Plc’s global head of G-10 foreign-exchange research, wrote in a Monday note. This suggests “further dollar strength needs a wallop rather than a dollop of dollar-supportive news.”

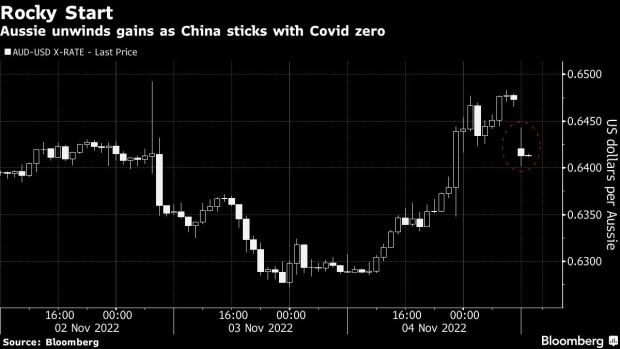

Risk assets remained bid on Monday even as China reiterated its commitment to Covid-Zero on Saturday. Speculation the Asian country was edging away from the policy catapulted risk appetite on Friday, leading the dollar through its worst one-day slump since March 2020. In addition to the results of US mid-term elections, attention is also turning to US consumer price data on Thursday.

Read more: Goldman Sachs Sees ‘Very Plausible’ Path to Avoid US Recession

“China has been unambiguous over the weekend that easing lockdowns is not happening and a strong labor market only gives a green light to the Fed to hike further,” said Tim Baker, head of macro research at Deutsche Bank AG in Sydney. A strong inflation print “could lift the December Fed pricing a bit closer to 75 basis points, which would help the dollar and hurt equities and bonds.”

Peak Dollar

Debate is heating up whether the dollar is near its peak after the Fed’s latest rate hike, with its fortunes hanging in the balance as traders parse economic data to get a better grip on the outlook on US policy. Some investors such as M&G Investments are turning more cautious about the Fed’s tightening path and reducing long bets on the greenback.

TD Securities said upward pressure on the dollar may start to ease as its sensitivity to interest-rate hikes reduces, though others including Commonwealth Bank of Australia Ltd. reckon investors shouldn’t write off the dollar’s strength just yet.

“A higher peak Funds rate can further widen US-major trading partner interest rate differentials and will support the dollar,” CBA strategists including Carol Kong wrote in a note.

--With assistance from Ruth Carson, Matthew Burgess and Philip Sanders.

(Updates dollar and Treasuries move throughout)

©2022 Bloomberg L.P.