US Small-Business Rent Delinquencies Rise to a Three-Year High

The delinquency rate for US small businesses climbed to a three-year high this month, reflecting the impact of rent spikes and declining revenue, according to a monthly survey.

Latest Videos

The information you requested is not available at this time, please check back again soon.

The delinquency rate for US small businesses climbed to a three-year high this month, reflecting the impact of rent spikes and declining revenue, according to a monthly survey.

Apollo Global Management Inc., KKR & Co. and Stonepeak may inject billions of dollars into a joint venture that will help fund Intel Corp.’s semiconductor fabrication facility in Ireland, according to people with knowledge of the matter.

Cava Group Inc. is planning to further expand its footprint in the Chicago area and other areas of the Midwest, making a contrarian bet that the region will reverse population declines that have plagued it in recent years.

Donald Trump’s lawyer at his “hush money” trial sought to cast doubt on claims that a tabloid publisher’s $150,000 deal with an ex-Playboy model to keep quiet about an alleged affair was an attempt to influence the 2016 election.

Mexican companies are pushing ahead with plans to sell shares, seeking to tap renewed interest from global equity investors, according to the head of Barclays Plc in the country.

May 20, 2019

, Bloomberg News

(Bloomberg) -- Home buyers may soon be able to borrow more in Australia, after the banking regulator proposed lowering the minimum interest rate lenders use to asses whether borrowers can afford their repayments.

Currently, most lenders use a rate of 7.25% to assess whether a borrower can meet their repayments, even though many mortgage rates are 4% or lower.

Under new proposals from the Australian Prudential Regulation Authority, lenders would be permitted to review and set their own minimum interest rate floor as long as it builds in a 2.5% buffer above the borrower’s mortgage rate.

“With interest rates at record lows, and likely to remain at historically low levels for some time, the gap between the 7% floor and actual rates paid has become quite wide, in some cases possibly unnecessarily so,” APRA Chairman Wayne Byres said in a statement Tuesday.

The move could give a boost to the soggy housing market by allowing home buyers to borrow more. House prices in Sydney have slumped 14.5% from their mid-2017 peak, and Melbourne property values are down 11%, according to CoreLogic Inc. data.

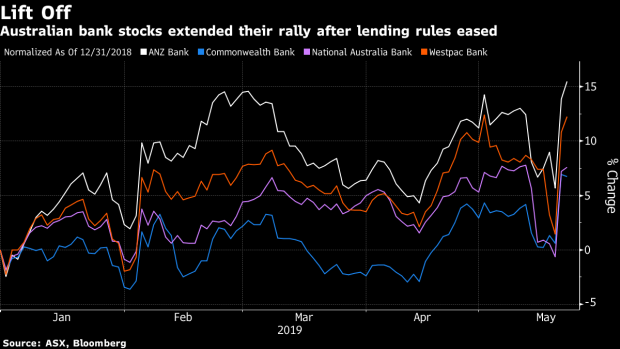

Bank shares gained for a second day, having surged Monday after Scott Morrison’s center-right government pulled off a shock election win, killing opposition plans to wind back tax breaks for property investors.

Westpac Banking Corp. rose 1.9% in early Sydney trading; National Australia Bank Ltd. added 1.4% and Australia & New Zealand Banking Group Ltd. gained 1.7%.

“Being a catalyst for easing credit conditions, it would be a positive, potentially for the housing market,” said Ryan Felsman, a senior economist at the securities unit of Commonwealth Bank of Australia. “In terms of the bottoming of the housing market, that may mean it occurs a bit more quickly than expected, perhaps.”

(Adds banks shares, economist comment.)

--With assistance from Matthew Burgess.

To contact the reporter on this story: Peter Vercoe in Sydney at pvercoe@bloomberg.net

To contact the editors responsible for this story: Katrina Nicholas at knicholas2@bloomberg.net, Edward Johnson

©2019 Bloomberg L.P.