May 23, 2022

Australia Pension Investments Lost A$55 Billion in March Quarter

, Bloomberg News

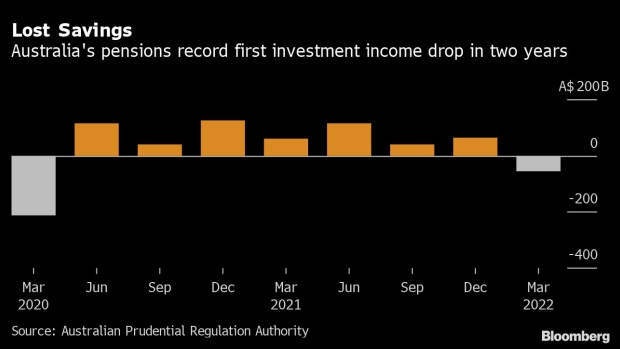

(Bloomberg) -- Australian retirement system assets shrank 0.9% to A$3.4 trillion ($2.4 trillion) in the three months through March as markets were roiled by the prospect of steeper rate hikes and Russia’s increased aggression against Ukraine.

The drop was driven by a A$55 billion loss on funds’ investment income, the first drop in two years, as volatility in equity markets increased, according to Australian Prudential Regulation Authority data. Defensive assets like fixed income and property also fell, the figures published Tuesday show.

Australia’s pensions were directed to sell their Russian assets, even if this meant a significant loss, to conform with sanctions imposed over the war on Ukraine.

Investment income will remain pressured, with global stocks down about 11% so far this quarter and on track for the worst quarterly loss since March 2020. More than half of Australia’s retirement savings are invested in Australian and global stocks, the data show.

©2022 Bloomberg L.P.