Oct 31, 2022

Australia Raises Key Interest Rate, Signals More Hikes to Come

, Bloomberg News

(Bloomberg) -- Australia’s central bank raised interest rates by a quarter-percentage point and signaled further tightening to come as it combats escalating inflation.

The Reserve Bank’s board lifted the cash rate to 2.85%, the highest level since April 2013, in a widely expected result. The decision, which underlined the RBA’s pivot away from outsized hikes last month, sent three-year bond yields sliding as much as 15 basis points, while stocks surged 1.7% on the day.

The RBA’s downshift to smaller rate hikes together with inflation seen holding above its 2-3% target through 2024 suggest Governor Philip Lowe is laying the ground for an extended tightening cycle.

“It looks like the RBA is now set on a string of 25-basis-point increases,” said Tapas Strickland, head of market economics at National Australia Bank Ltd. He sees a risk of rates peaking “closer to 3.85% or a little higher.”

The RBA’s consecutive quarter-point moves contrast with the Federal Reserve and Bank of England, which are forecast to unleash 75 basis-point hikes this week. That divergence has driven a sizable yield differential between US and Australian 10-year yields.

Earlier this week, US 10-year yields rose to 29 basis points above similar-dated Australian rates -- the largest premium since March 2020.

David Plank, head of Australian economics at Australia & New Zealand Banking Group Ltd. said the tone of today’s statement was “less hawkish” than he had expected.

“The RBA is now prepared to tolerate inflation above target for a longer period,” he said. “The bigger question now is whether the cash rate goes above 4%.”

Money market pricing implies a peak of just under 4% by mid-2023. The median of economists surveyed by Bloomberg prior to today’s statement shows the RBA halting at around 3.5%.

The central bank also provided headline numbers from its quarterly update of forecasts that will be released in full on Friday. It expects:

- inflation to now peak at around 8% later this year, slightly up from a previous 7.75%. It also sees inflation of 4.75% in 2023 and a little above 3% in 2024, also both higher

- economic growth at around 3% this year and 1.5% in 2023 and 2024, slightly down from August

- unemployment to rise gradually to “a little above” 4% in 2024

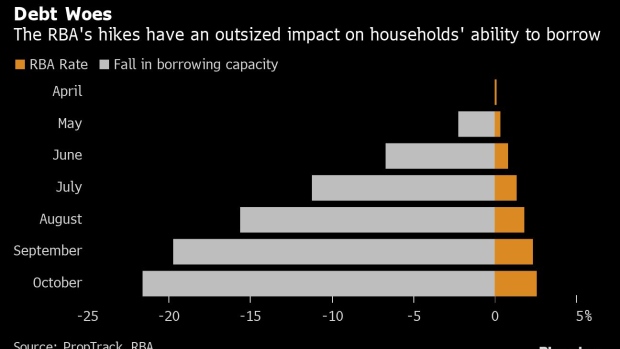

A key risk to Australia’s A$2.2 trillion ($1.4 trillion) economy is an accelerating downturn in the housing market. Data Tuesday showed prices declined in every major city last month in response to rising rates and expectations of further policy tightening ahead.

What Bloomberg Economics Says...

“The RBA’s outlook for weaker growth, higher unemployment and contained medium-term inflation suggest it’s close to the end of the rate hike cycle. We think the RBA will deliver a final hike in December, before stopping as demand sours and inflation peaks”

-- James McIntyre, economist

For full note, click here

One reason for the RBA’s divergence from global peers is it meets more frequently -- every month bar January -- allowing it to move in smaller increments. Lowe is also mindful of the impact of higher borrowing costs on a household sector that’s struggling under a debt-to-income ratio of 187%.

About 60% of Australian mortgages are also on variable rates, while fixed rates are typically for only two- to three years, unlike the US where 90% of home loans are fixed for 30 years.

So far, Australia’s heavily indebted households have proved resilient to higher borrowing costs and a spike in living costs. Data Monday showed retail sales rose more than expected in September. Job ads also remain high, indicating further falls in unemployment that’s already hovering near a 50-year low.

Today’s statement “acknowledged the lags in policy transmission, which is an argument for not trying to solve inflation issues immediately,” said Ben Jarman, an economist at JPMorgan Chase & Co. “That discretion is a luxury some other central banks like the BoE and Fed cannot afford.”

--With assistance from Tomoko Sato, Georgina Mckay and Garfield Reynolds.

(Adds comments from economists.)

©2022 Bloomberg L.P.