Sep 6, 2022

Australia’s Central Bank Raises Key Rate to Seven-Year High, Signals More to Come

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Australia’s central bank raised interest rates by a half-percentage point for a fourth consecutive meeting and signaled further hikes ahead in its drive to rein in inflation.

The Reserve Bank took the cash rate to 2.35%, the highest level since 2015, in a widely expected announcement on Tuesday. The tightening is Australia’s quickest in a generation with the cycle beginning in May at a record-low 0.1%.

Today’s decision reflects a resolve among global central bankers to keep increasing borrowing costs until inflation meaningfully eases, even at the cost of economic growth. RBA chief Philip Lowe has been pushing rates toward 2.5%, close to a neutral level that’s neither expansionary nor contractionary.

The governor’s relatively vanilla post-meeting statement means investors and economists are now turning their attention to his major set-piece speech on Thursday for guidance on Australia’s policy path.

“I think they will move to quarter-point hikes from here,” said Gareth Aird at Commonwealth Bank of Australia, the nation’s largest lender. “They are recognizing that they are now at a neutral policy setting.”

Aird, head of Australia economics at CBA, sees the central bank pausing at 2.6-2.85%, a call he plans to firm up after Lowe’s speech Thursday.

Highlighting the approach toward neutral, Lowe’s statement removed a reference to the RBA’s hikes representing a normalization of rates. The central bank is leaning on a tight labor market and still-strong household spending to keep the economy buoyant during the rapid tightening phase.

What Bloomberg Economics Says...

“We think that with monetary policy now on the restrictive side of neutral the RBA is close to reaching the point at which tightening must slow, enabling time to assess the impacts of earlier hikes the economy”

-- James McIntyre, economist.

For the full report, click here

The central bank’s forecasts show inflation peaking at just under 8% late this year and holding above the upper end of its 2-3% target over 2023, underscoring the need for further tightening.

It has highlighted the strong performance of Australia’s A$2.2 trillion economy, which has been rare beneficiary of Russia’s war on Ukraine as soaring commodity prices brought record trade surpluses and boosted national income.

Australia reports gross domestic product for the three months through June on Wednesday and economists predict a 0.9% gain from the prior quarter and 3.4% from the year earlier period.

Yet with inflation exceeding wage growth, Australians’ incomes are being eroded, while rising rates in an economy with among the highest household debt in the developed world means consumption is set to be squeezed.

Lowe acknowledged this is an “important source of uncertainty,” adding it’s clear the trajectory of policy and prices is “putting pressure on household budgets.” The full effects of 2.25 percentage points of rate hikes are also still “yet to be felt in mortgage payments,” the governor added.

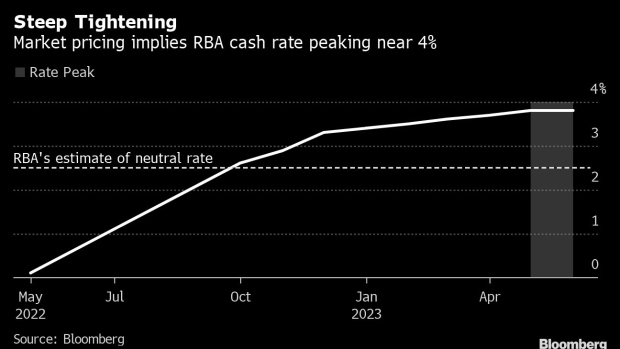

Adding to the uncertainty, swaps are pricing in a further 1 percentage point of hikes by year’s end. At present, the median estimate of economists is for the cash rate to peak at 3% in this cycle, versus markets’ 3.8% by mid-2023.

There are signs that a long-awaited acceleration in wage growth is taking hold, a relief for households hit by inflation that shows few signs of abating. But it’s a worry for policy makers who need to guard against a wage-price spiral.

A further risk is the property market. Data last week showed housing credit growth eased and house prices fell at the fastest pace since 1983.

Economists point out that RBA tightening tends to take about two to three months to flow through to households, suggesting consumption will start to weaken markedly by year’s end.

“Geopolitical risk is also elevated and as we have seen this year, can flow to the real economy,” said Jo Masters, chief economist at Barrenjoey Markets Pty Ltd. “The outlook for China is always a risk for Australia, and there we are seeing pressures in the housing market that bear close attention.”

(Adds comments from economists.)

©2022 Bloomberg L.P.