Jun 7, 2023

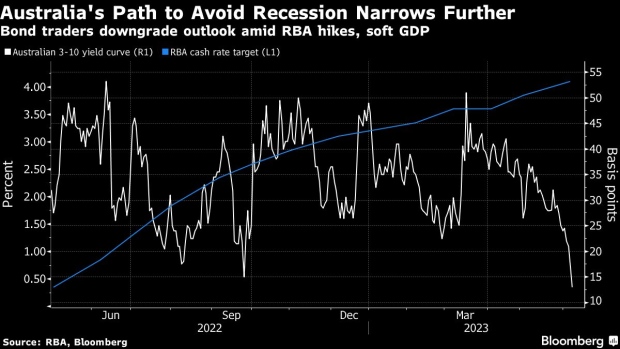

Australia’s Crashing Yield Curve Doubts RBA Hope of No Recession

, Bloomberg News

(Bloomberg) -- Australia’s bond market is showing serious concern the central bank will hike the country into a recession.

The nation’s key yield curve — the gap between yields on 10- and three-year government bond futures — shrank to 13 basis points Wednesday after data showed the economy slowed more than expected last quarter, while accelerating labor costs underlined the nation’s inflation challenge.

That put the gauge on track for its lowest closing level since 2010, and defies the Reserve Bank of Australia’s goal to achieve a soft landing even after the steepest interest-rate hikes in a generation.

The RBA surprised investors Tuesday with another rate increase and the GDP release spurred some in the market like Goldman Sachs Group Inc. to raise their expectations for further hikes. Traders are now pricing in another full hike by September.

“A recession looks inevitable,” Andrew Canobi, director of fixed income at Franklin Templeton’s Australian unit, said. Adding to duration — boosting a portfolio’s sensitivity to changes in interest rates — “will ultimately work but it’s been a bumpy ride”

--With assistance from Matthew Burgess.

©2023 Bloomberg L.P.