Mar 26, 2024

Australia’s Inflation Holds Steady for Third Straight Month

, Bloomberg News

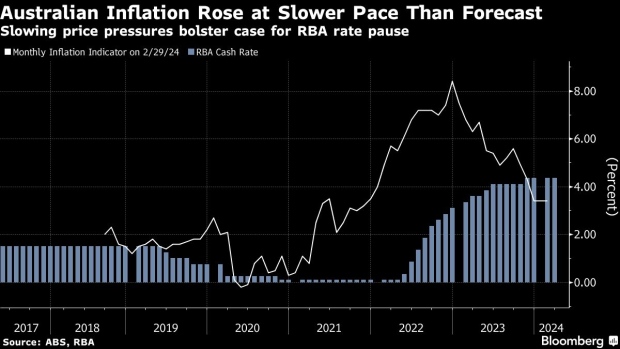

(Bloomberg) -- Australian inflation was steady for a third straight month in February, supporting the Reserve Bank’s decision to keep interest rates unchanged at a 12-year high last week.

The consumer price indicator advanced 3.4% from a year earlier, slightly less than economists’ estimates of 3.5% and matching January and December’s readings, Australian Bureau of Statistics data showed on Wednesday.

When excluding volatile items, the annual rise eased to 3.9% from January’s 4.1%, still well above the RBA’s 2-3% target band.

The Australian dollar fell as far as 65.21 US cents and the policy-sensitive three-year government bond yield also declined, while stocks extended gains.

The result follows the RBA’s March 19 rate decision when it left borrowing costs at 4.35% and dropped a tightening bias. Governor Michele Bullock reckons that aggregate demand remains above the economy’s supply potential, though she has signaled increased confidence recently that monetary policy is working to bring inflation back to target by 2025, as forecast.

While policymakers will review Wednesday’s figures, the key inflation data will be first-quarter CPI on April 24, which will feed into the RBA’s economic forecast ahead of the next board meeting on May 6-7.

Economists predict the RBA will embark on an easing cycle in the third quarter and money markets maintained pricing for a rate cut as early as August.

The CPI result showed:

- Housing climbed 4.6% and insurance and financial services 8.4%

- Inflation in food and non-alcoholic beverages slowed to the weakest annual pace since January 2022

“Rents increased by 7.6% for the year, up from 7.4% in January, reflecting a tight rental market and low vacancy rates across the country,” the ABS said. “New dwelling prices rose 4.9% over the year with builders passing through higher costs for labor and materials. Annual new dwelling price increases have been around the 5% mark for the past six months.”

The RBA’s current forecasts show the CPI will only fall back within target in December 2025.

Earlier this week, Treasurer Jim Chalmers said that inflation is moderating despite some volatility.

“It’s already clear the direction of travel in inflation is welcome and encouraging,” Chalmers said.

(Adds further details from report.)

©2024 Bloomberg L.P.