Jun 16, 2021

Australian Unemployment Tumbles to 5.1% in May as Jobs Surge

, Bloomberg News

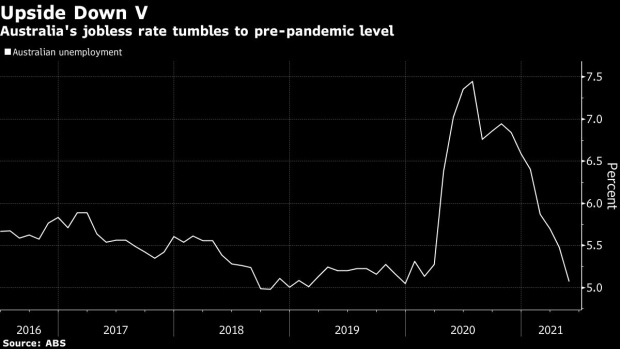

(Bloomberg) -- Australia’s unemployment rate tumbled in May in response to a burst of hiring, led by full-time positions, underscoring the economy’s ongoing momentum supported by fiscal-monetary stimulus.

The jobless rate declined to 5.1% in April, well below economists’ estimate that it would remain unchanged at 5.5%, data from the Australian Bureau of Statistics showed Thursday in Sydney. The economy added 115,200 roles versus a forecast 30,000 gain, while the participation rate climbed to 66.2%.

The decline in the jobless rate is now back to the level in February 2020, said Bjorn Jarvis, head of labor statistics at the ABS. “The declining unemployment rate continues to align with the strong increases in job vacancies,” he added.

The Australian dollar jumped 0.3% to the day’s high of 76.45 U.S. cents as some traders rushed to cover short positions, according to an Asia-based FX trader.

The yield on sovereign bonds that mature in November 2024 surged almost 12 basis points as investors bet that a more hawkish Federal Reserve and the stronger jobs data add to the case for the Reserve Bank of Australia to decide against rolling forward its yield control. The spread between April and November 2024 notes surged to over 30 basis points.

Australia has transitioned from recovery to expansion after recouping jobs and output lost during the pandemic. Thursday’s data suggests the economy has managed to absorb losses from the end of the government’s signature JobKeeper wage subsidy in late March.

Withdrawal Weathered

“The labor market has weathered the withdrawal of JobKeeper very well,” said Sean Langcake, a senior economist at BIS Oxford Economics. “The recovery took a pause in April following the last JobKeeper payments at the end of March. But there are no signs of lingering effects in today’s data. Participation is back around an all-time level.”

Both the RBA and Treasury expect employment will keep strengthening, based on job advertisements and other forward indicators. Yet there may also be some weaker readings ahead after Melbourne was forced back into a two-week lockdown to contain a Covid-19 outbreak.

Among other details in today’s report:

- Monthly hours worked increased 1.4% in May

- Under-employment decreased by 0.3 percentage point to 7.4%

- Under-utilization fell 0.7 point to 12.5%

- Full-time jobs advanced by 97,500 in May and part-time positions by 17,700

The RBA is due to decide in less than three weeks whether to roll over its three-year yield target bond to November 2024 from the current April 2024 and the scale of any further quantitative easing. Its current A$100 billion ($76 billion) tranche of QE is due to conclude in September.

The government has joined forces with the central bank in trying to push unemployment down toward 4% to spur wage growth and rekindle inflation. Treasurer Josh Frydenberg announced targeted additional fiscal support in his May budget to keep supporting the economy.

The RBA’s updated quarterly forecasts released last month show the jobless rate falling to 5% by the end of this year and 4.5% at the end of 2022. Under an optimistic scenario for unemployment, the rate could decline to 3.75% by mid-2023, the forecasts showed.

Australia’s containment of Covid has underpinned a recovery in sentiment that’s seen households spend and firms flag further investment. However, Melbourne’s lockdown did put a damper on the latest consumer confidence reading.

Yet business conditions -- which measures hiring, sales and profits, and is monitored by the RBA -- rose in May to a fresh record.

(Updates with comment from economist in sixth paragraph.)

©2021 Bloomberg L.P.