Jan 31, 2023

Bank of Korea Dissenters Are Uneasy About Impact of Higher Interest Rate on Already Slowing Economy

, Bloomberg News

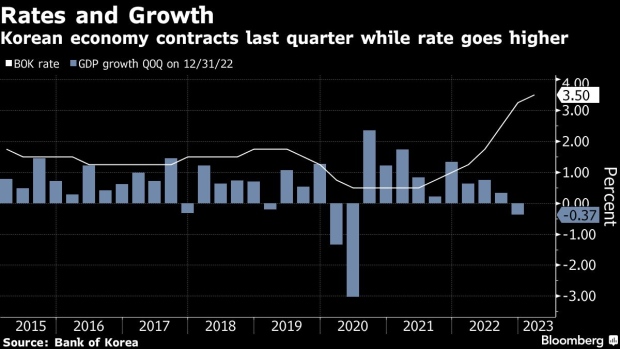

(Bloomberg) -- The Bank of Korea’s benchmark interest rate was already having a hard impact on a sputtering economy before it was raised again earlier this month, according to two board members who voted against the hike.

The South Korean central bank raised the rate to 3.5% from 3.25% on Jan. 13 in a move that markets interpreted as the final act of an 18-month tightening cycle.

Two of seven board members voted against the hike, putting the emphasis on safeguarding the economy, according to minutes released Tuesday.

The presence of two dissenters suggests the central bank is likely to pause its tightening when it meets in February to decide on policy. Governor Rhee Chang-yong has kept the door open for more tightening while hinting that the BOK will seek a more balanced policy response this year.

One dissenter expected the BOK to stick with its final rate for a “significantly long period of time,” a factor that could excessively hurt economic momentum. The other dissenter said a setting of 3.25% was already “significantly tight” given that the economy this year would grow less than expected.

Both expressed worries about the negative effect of housing-market downturns on the economy, private consumption and credit.

Some of the other members who supported the quarter-point hike saw the deleveraging of household debt as a necessary process.

Of the seven members, three said tightening has likely ended at 3.5%, while three others said they didn’t want to close the door on a further increase, Rhee said after the decision. The governor hasn’t disclosed his view.

©2023 Bloomberg L.P.