Mar 9, 2023

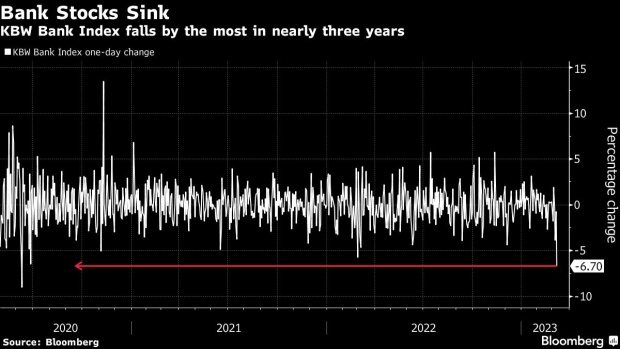

Bank Stocks Sink Most in Nearly Three Years as Sentiment Sours

, Bloomberg News

(Bloomberg) -- US bank stocks tumbled by the most in almost three years after a Silicon Valley-based lender took steps to shore up its capital position, stoking concern that soaring interest rates are eroding balance sheets across the financial industry.

The KBW Bank Index sank 7.7%, its biggest drop since June 2020. SVB Financial Group, a firm that specializes in venture-capital financing, was the gauge’s biggest decliner, sinking a record 60% after it announced a stock offering and sold off a chunk of the securities in a portfolio that’s been hit by heavy losses. Bank of America Corp., Wells Fargo & Co. and JPMorgan Chase & Co. all slid at least 5%.

SVB’s Silicon Valley Bank news is “the prevailing fear here,” Gary Tenner, an analyst at DA Davidson, said in an interview. “Is this the dam that has burst with regards to more banks raising capital? Is there more to come?”

Banks that accumulated loans and other investments when interest rates were low have seen the value of those assets erode amid the rapid rise of rates engineered by the Federal Reserve. At the same time, bankers have to compete harder to keep savers from defecting. This means banks have to pay more to keep customers in place — or else in some cases sell off some of those low-yielding assets at deep discounts to pay off the depositors. For smaller regional and community banks, losing deposits can be serious and weigh heavily on profitability.

Adding to the souring sentiment was Silvergate Capital Corp., which said it plans to wind down operations and liquidate after the crypto industry’s meltdown sapped the company’s financial strength.

“Bank stocks were already trading poorly this week after KeyCorp warned about elevated deposit betas and the selling intensified on Thursday thanks to the double whammy of Silvergate and SVB Financial,” Vital Knowledge founder Adam Crisafulli said.

Read more: SVB Drops Most on Record as Startup Clients Face Cash Crunch

And the competition for deposits is intensifying. Only about a quarter of the 425 basis-point increase in the Fed’s benchmark had been passed along to depositors through the end 2022, according to Barclays Plc strategist Joseph Abate. Those bank rates are nearly 200 basis points lower than seven-day yields on government and prime money-market funds, and 260 basis points lower than four-week Treasury bill yields, the widest in more than 30 years.

Thursday’s plunge completely wiped out what had been a strong start to 2023 for bank stocks. The KBW Bank Index was up more than 14% to begin the year, but declines across four of the last five weeks have pushed the benchmark back into the red.

Bank Test

“This ‘SIVB moment’ can not be unseen,” Mike Mayo, an analyst at Wells Fargo & Co., said in a note, referring to SVB’s stock ticker. “This is part of the test that the largest banks, i.e., the ones that caused the global financial crisis, are today the more resilient portion of both the banking and financial systems.”

Jens Nordvig, founder of Exante Data and Market Reader, said all the risks from higher interest rates haven’t been reflected in asset prices yet.

“We have been in a zero-interest regime for a multiyear period and banks have operated in a certain way,” Nordvig said. “Certain banks are going to have difficulty in a totally different environment.”

Jim Mitchell, an analyst at Seaport Research, said that with banks’ first-quarter results just a month away, some investors might be getting skittish about the firms’ exposure to US deposit pressures.

“We believe today’s news doesn’t change the outlook for the large global banks under coverage (and today’s selloff seems unwarranted),” Mitchell said in a note. Banks less reliant on deposits, such as Goldman Sachs Group Inc. and Citigroup Inc., “may continue to hold up better.”

--With assistance from Alexandra Harris, Sridhar Natarajan and Jenny Surane.

©2023 Bloomberg L.P.