Jan 30, 2023

Barclays, Deutsche Bank Set to Top European Bond Trading Surge

, Bloomberg News

(Bloomberg) -- For the fifth straight quarter, European banks are set to match or beat Wall Street rivals after a debt trading surge last year saw revenues surge by almost 30%.

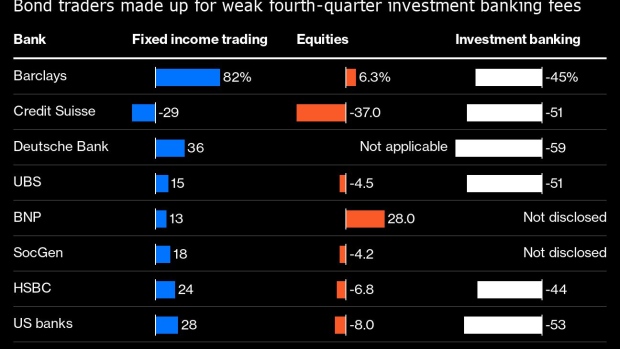

Six of the region’s top investment banks — led by Barclays Plc and Deutsche Bank AG — are expected to show an average 29% increase in bond and currency trading in the three months through December, slightly ahead of the pool for such revenue at US banks, according to analyst estimates compiled by Bloomberg.

The averages don’t include Credit Suisse Group AG, which is expected to show large declines in trading revenue as it scales back the business as part of a broader overhaul. UBS Group AG will be the first major European investment bank to report earnings on Tuesday.

Global banks are seeing the benefit of rapid interest rate hikes by central banks in their fight against inflation feed through to both bond trading desks as well as their traditional savings and loan business. For European fixed income traders, 2022 is set provide some respite or potentially even become a turning point after several years of losing market share to their larger US competitors in dollar terms.

The US firms cited strength in so-called macro businesses such rates rates trading and foreign exchange while facing a more challenging environment for dealing in corporate bonds.

The boost from interest rates is helping to cushion the blow from the fallout of Russia’s invasion of Ukraine. The economic uncertainty resulting from the war has sliced banks’ revenue from issuing stocks and bonds as corporate executives hold off from making deals. Advisory and origination revenues at five European banks is expected to plummet 50% in the quarter, a similar figure to the pool for the top US firms.

BNP Paribas SA is expected to excel in an otherwise muted quarter in equities trading where several European firms may struggle to keep up with several US peers. The French lender has expanded in prime brokerage, the business of catering to hedge funds, while European competitors withdraw.

Inflation and the increase in borrowing costs has also heightened the threat of a wave of defaults by corporate borrowers, commercial real estate firms and on residential mortgages in some markets. That has sharpened calls by regulators for banks to keep a close watch on credit risks and to avoid paying out capital via dividends and share buybacks if it could put them in a tight spot later on.

A jittery quarter on the back of economic and geopolitical risks may give way to greater optimism, easing the pressure on banks to curtail investor payouts. The business outlook in Germany, Europe’s largest economy, brightened in January amid falling gas prices and signs that record inflation may ease sooner than expected.

Those returns are a key area of focus for investors. Intesa Sanpaolo SpA said it will decide on a €1.7 billion ($1.85 billion) buyback by Feb. 3, while BNP Paribas will provide details on proceeds from the sale of a US unit next week, some of which it plans to use to repurchase stock.

Bankers have so far been sanguine about their ability to cope with the economic risks and their earnings are proving to be the first line of defense. At ten of the euro area’s largest banks, net interest income — the difference between what they charge for credit and their costs of borrowing — will probably jump 18% to €39 billion in the quarter from a year earlier.

“We all anticipate a potential shock but if we look at our indicators, they’re all very good,” Andrea Orcel, the chief executive officer of UniCredit SpA, said in an interview with Francine Lacqua on Bloomberg TV earlier this month. “We had a slower October, November, but from December, the pace both in the corporate sector and on family level has increased.”

©2023 Bloomberg L.P.