Feb 25, 2022

Beyond oil and gas: Who’ll lose from Russia-Ukraine trade fallout

, Bloomberg News

Commodities are pulling back from highs as sanction concerns dissipate: Tracy Shuchart

Russia’s invasion of Ukraine has sparked Europe’s largest land war since 1945, raising the prospect of an exodus of refugees and posing a serious threat to global trade flows. While the focus is on Russia’s energy exports, there are plenty of other potential chokepoints, ranging from food staples and strategic metals to luxury items.

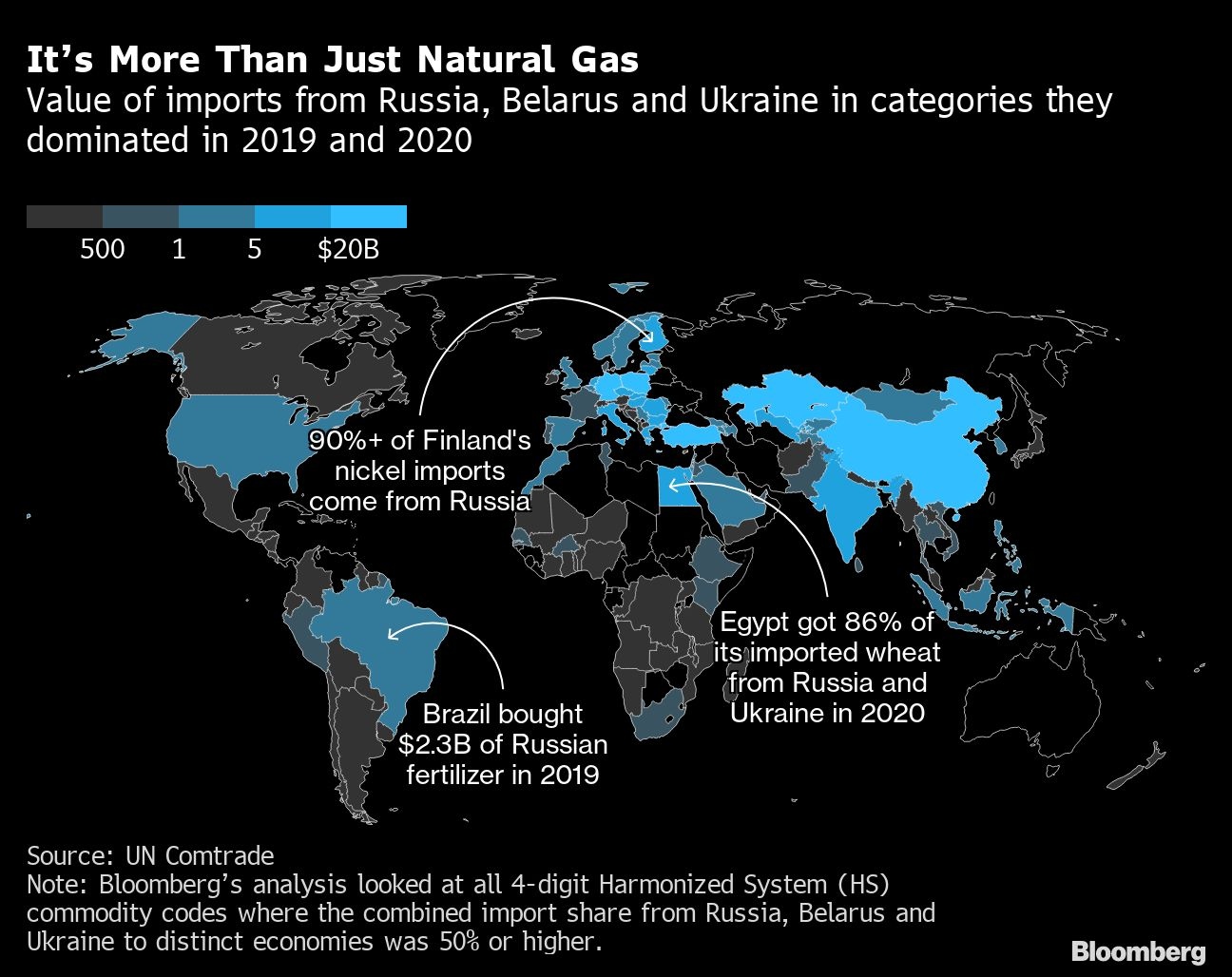

In all, more than 130 economies have at least one good or commodity import that is predominantly sourced from Russia, Ukraine and neighboring Belarus, which Moscow is using as a base for some of its forces, according to a Bloomberg News analysis of figures since 2019 from the United Nations’ Comtrade database for global trade.

The U.S., European Union and U.K. have so far focused their sanctions on Russia’s financial sector, billionaires and political elites—giving a pass to the country’s energy industry, which continues to pump natural gas to heavily-reliant European customers.

Yet Western leaders have said that all options remain on the table. And there are signs that even China, a close ally of Russia, may be applying a squeeze, with several state-run banks curbing financing for purchases of Russian commodities.

As well as being an energy giant, Russia is also a major producer of base and precious metals. Ukraine is one of the world’s largest agricultural exporters.

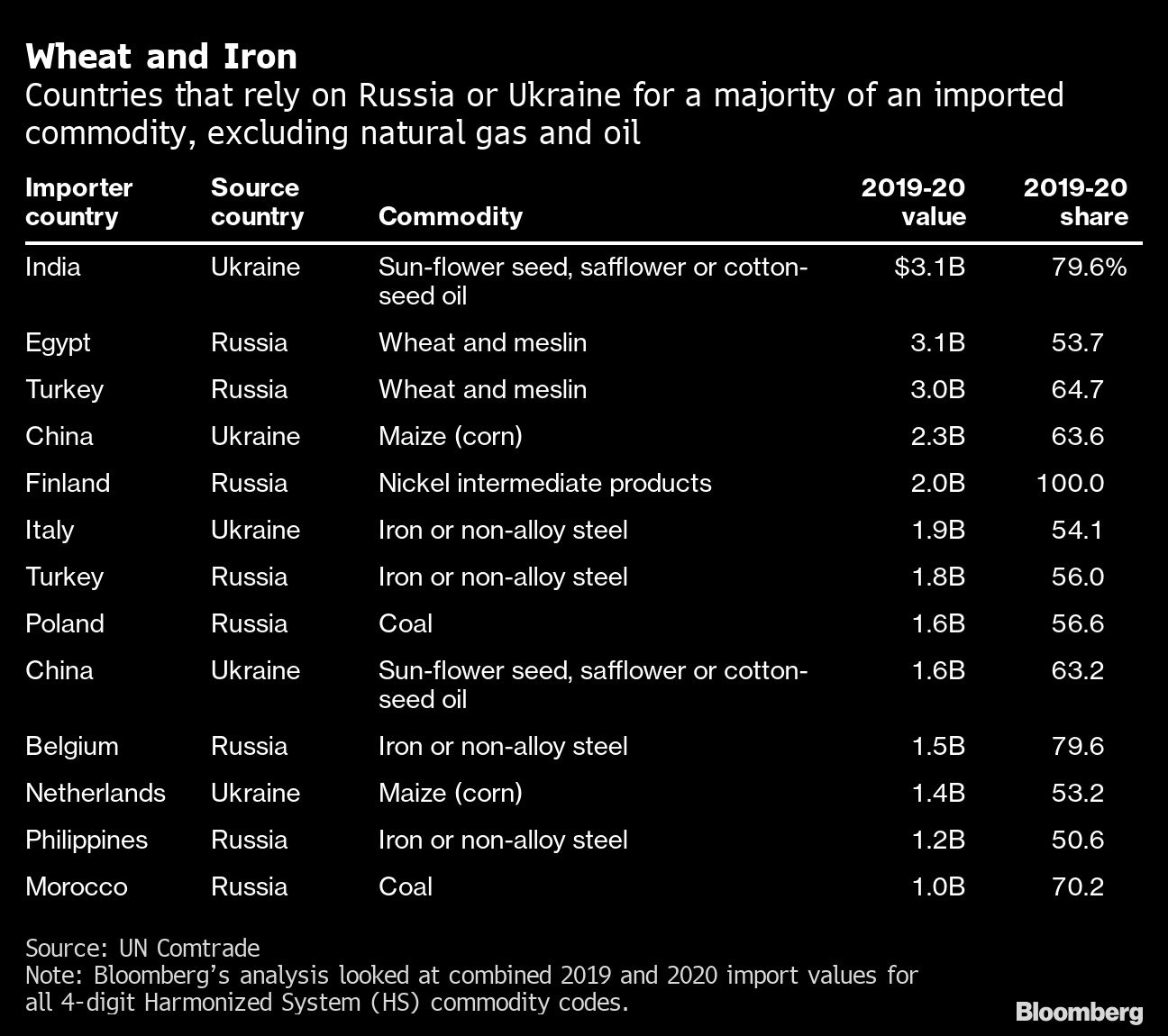

Finland gets more than 90 per cent of its nickel imports from Russia, which also supplies nearly half of Turkey’s aluminum imports. The U.K. is by far the largest buyer of Russian gold, to the tune of US$17 billion in 2020.

Even the U.S. may have some exposure. In 2020, the U.S. bought 3.5 million metric tons of pig iron—a key ingredient in the production of steel—from Russia and the Ukraine. That amounted to three-quarters of its overall imports of the metal that year, and was equivalent to 19 per cent of domestic output.

Egypt and Turkey both get more than 50 per cent of their wheat imports from Russia and Ukraine. India and China import hundreds of millions of dollars of sunflower and cotton-seed oils from the Ukraine. In 2019, both Brazil and China sourced at least 30 per cent of their fertilizer imports from Russia and Belarus, collectively worth US$4.3 billion, with the U.S. and India also major buyers.

For a few countries and products, Russia is a major customer, and there’s a risk that demand could be hurt by future sanctions and other economic fallout.

One example: the more than US$5 billion in fur coats, clothing and accessories that Russians bought from Chinese manufacturers in 2019 and 2020—nearly two-thirds of their overseas sales. Ecuador sells almost 20 per cent of its bananas, worth more than US$600 million annually, to Russia. The country is also a key market for Finnish nuclear-reactor parts.