Apr 28, 2021

Big Government Is Set for a Rerun With Biden’s Economic Plan

, Bloomberg News

(Bloomberg) -- Big government is back.

Four decades after Ronald Reagan’s philosophy of lowering taxes and shrinking government took hold -- culminating in Donald Trump’s 2017 tax cuts -- Joe Biden is turning U.S. economic policy in the opposite direction.

Over the past 14 months, Congress passed three pandemic-relief packages that injected almost $5 trillion into the economy. The president, according to his latest plan unveiled Wednesday, will make the case for an additional $1.8 trillion in spending and tax credits on initiatives from education and child care to paid family and medical leave.

And that’s on top of $2.25 trillion in infrastructure, home health care and other outlays proposed last month. The raft of new spending would be funded by a host of tax hikes directed at corporations and wealthy Americans.

It’s all aimed at raising productivity, expanding the workforce and spreading the benefits of the U.S. economy more equitably.

Economists from the left and right have profoundly different opinions on whether this will benefit or damage the U.S. economy. And there is little certainty over how much of the package Biden can navigate through Congress, given Democrats’ razor-thin majorities and staunch Republican opposition.

Even if the proposals are pared back, though, there is growing recognition that a great shift is under way in American politics, one that’s poised to end the small-government philosophy that dominated Washington for much of the last 40 years.

“I don’t think that’s exaggerating,” William Gale, an economist and senior fellow at the Brookings Institution in Washington, said of the philosophical shift. “There’s been a recognition that the supply-side revolution really hasn’t produced what was promised.”

As a result, Gale said, the range of what’s even permissible to discuss when debating public policy, including how much to tax and spend, has moved.

Reagan Years

“Supply-side” refers to the economic and political philosophy popularized during the Reagan administration in the 1980s. Its proponents argued that lowering taxes and shrinking government would spur more private investment, allocating capital more efficiently and generating greater economic growth, which benefits all.

Liberals and conservatives tend to gauge the results through different lenses. The former point to annual GDP growth in the U.S. that has averaged 2.3% since 1991 and 1.7% since 2001.

That compares with 4% in the 1950s through 1970s -- the era of postwar big government and higher taxes. Lower levies and the erosion of social welfare services have also contributed, liberals argue, to a troubling widening of economic inequities and the neglect of infrastructure, education and other public goods.

Against that backdrop, Biden says the pandemic has been particularly devastating to low-income Americans, exacerbating long-festering economic and social problems. After campaigning hard on the spending and taxation ideas he’s now urging Congress to pass, Biden and his aides say his election victory and recent polling provide evidence that Americans support his approach.

Biden’s infrastructure plan had a 68% approval rating in a Monmouth University poll released Monday, while 64% said they would support a large spending plan with provisions on child care, education and health care, like Wednesday’s “American Families Plan.”

That poll also found that nearly two-thirds of Americans supported paying for Biden’s plans by raising taxes on corporations and on individuals making more than $400,000.

Middle Class

“One thing the pandemic did expose is the fact that the government needs big programs,” said Ted Kaufman, a longtime Biden adviser who co-chaired his presidential transition. “Reagan’s idea was that government can’t do anything right. Well I think the government does do things right and needs to do things right for the middle class.”

Insofar as they also address economic inequality, the plan may also appeal to much of the Democrats’ political base.

Biden’s proposals represent “really sound economic policy, and they have important racial equity implications,” said Bradley Hardy, chair of the department of public administration and policy at American University in Washington. “So the selling of the plan can also include talking about those benefits.”

On the conservative side, many recognize that infrastructure and education need investment and reform. But they reject the idea that lower taxes have led to lower growth.

It’s more instructive to compare different countries during the same time periods, said Mickey Levy, chief economist for the U.S. and Asia at Berenberg Capital Markets.

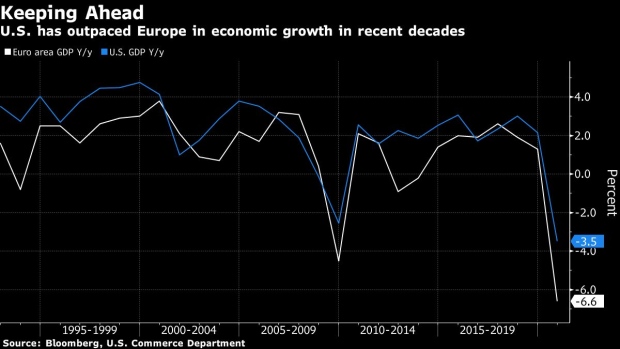

He points to consistently faster U.S. growth than in western European countries that have long embraced larger government and higher taxation. Indeed, since 1992, the euro area has grown an average 1.3% annually, versus 2.4% in the U.S.

“The notion that higher taxes wouldn’t hurt the economy and haven’t hurt the economy is wrong,” Levy said.

Biden’s proposal to raise the capital gains rate on high earners, and to close a loophole for capital gains taxation at death, will affect just 0.3% of households, according to the White House.

But even that may alter the way those wealthy families invest and have a knock-on effect for stock valuations and firms’ behavior, Levy said. On the corporate side, while some of the higher taxes would lower profits, much of it would hit workers through less employment or lower wages, he said.

Still, Levy doesn’t dispute that the political ground is shifting.

“The Reagan revolution for lower spending, lower taxes -- that was a significant shift in philosophy,” he said. “What’s gone on recently is definitely a dramatic shift toward a much larger not just size of government, but role of government.”

(Adds links to other coverage)

©2021 Bloomberg L.P.