Feb 8, 2024

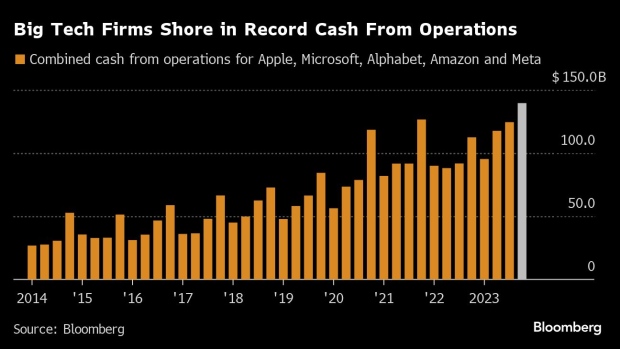

Big Tech’s $140 Billion Cash Haul Points to Shareholder Returns

, Bloomberg News

(Bloomberg) -- Big Tech is bringing in more cash than ever before, priming the group to return money to shareholders and potentially adding fuel to a rally that’s already sent most of the group into record territory.

The five biggest technology companies that have reported earnings so far — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and Meta Platforms Inc. — generated a record $139.5 billion of combined cash from operations in the quarter that ended on Dec. 31, according to data compiled by Bloomberg.

Investors can “expect excess free cash flow to largely be returned to shareholders given these companies already possess strong balance sheets and high net cash positions,” said Angelo Zino, senior equity analyst at CFRA Research. “Greater focus on capital returns will help contribute to shareholder value over time and is better than holding onto excess cash on the balance sheet.”

Only Apple, Microsoft and now Meta have dividend plans in this group. While having cash in the bank is a good position to be in, investors appreciate when companies invest any excess money for better opportunities or return it to shareholders.

In some ways, it has become more challenging for the firms to spend it. Amazon last month abandoned a $1.4 billion purchase of Roomba maker iRobot Corp. after clashing with European Union regulators. Microsoft eventually completed its $69 billion acquisition of video game maker Activision Blizzard, but only after two-years of trans-Atlantic scrutiny that threatened to scupper the deal.

Buybacks on the other hand are seen as a way to return profits to investors while reducing the number of shares outstanding — theoretically increasing the value of the remaining stock.

Such moves enable firms to demonstrate that they are profitable, well-performing and believe their shares are still undervalued. “The confidence signaled by the payment or increase of a dividend can be a powerful boost to sentiment,” said Russ Mould, investment director at AJ Bell.

Read More: Meta’s $197 Billion Surge Is Biggest in Stock-Market History

Meta showed what aggressive capital returns can do when it initiated a quarterly dividend and earmarked $50 billion in funds for share repurchases. Aided by a stronger than expected sales forecast, its stock on Friday saw the biggest single-day market value gain in market history.

“You rewind 10 years ago when a tech company starts giving a dividend — it’s usually the beginning of the end of growth,” Gene Munster, co-founder and managing partner at Deepwater Asset Management, said in an interview. But Meta’s dividend came alongside continued investments signaling “they believe they can achieve growth in AI and Reality Labs by doing this themselves,” he said, referring to the unit building the firm’s version of the metaverse.

Still, there are also reasons for investor caution, notes AJ Bell’s Mould, citing how buybacks can be used to juice earnings per share figures by reducing share count, for example.

Big Tech has spent about $186 billion on buybacks over the last 12 months, according to data compiled by Bloomberg. While Apple, Alphabet, Microsoft and Meta have consistently spent billions in buying back stock, Amazon has been a notable hold out recently.

The e-commerce giant is one of the most obvious candidates to increase its capital returns. It generated a record $42.5 billion in cash in the fourth quarter but didn’t repurchase any shares and doesn’t pay a dividend. Its cash and cash equivalents are at about $87 billion, just shy of a 2021 record.

“Stock buybacks are more likely to be the norm to boost EPS,” said Ted Mortonson, technology desk sector strategist at Baird. “In the ‘new GenAI’ world, paying a dividend will not be a signal of growth deceleration.”

Tech Chart of the Day

Arm Holdings Plc jumps as much as 41% on Thursday, its biggest intraday rise on record, after the chip designer’s third-quarter results surged past expectations, allowing the company to boost its full-year forecast. The stock also touched a fresh intraday record of $108.35.

Top Tech News

- SoftBank Group Corp. swung to its first profit after four quarters of losses and sketched out how it will reposition its strategy around artificial intelligence and its prized asset, Arm Holdings Plc.

- Chip designer Arm was headed for its biggest gain since the stock debuted in New York last year after issuing a surprisingly bullish earnings forecast, showing its push beyond smartphones is helping fuel growth.

- Apple Inc.’s limited release of the Vision Pro headset is fostering a resale market that’s pricing the device far beyond its $3,500 starting price.

- South Korean prosecutors are appealing a Seoul court ruling that cleared Samsung Electronics Co. Executive Chairman Jay Y. Lee of all charges including stock-price manipulation and accounting fraud.

- Elon Musk will provide financial support to a project using artificial intelligence to digitally unfurl ancient scrolls that’d been unreadable for centuries.

Earnings Due Thursday

- Premarket

- Dynatrace

- CyberArk

- Arrow Electronics

- Lumentum

- Belden

- Lightspeed Commerce

- Postmarket

- Motorola Solutions

- Cloudflare

- Verisign

- BILL Holdings

- Onto Innovation

- SPS Commerce

- Power Integrations

- Synaptics

- Impinj

- LiveRamp

- Pros Holdings

--With assistance from Tom Contiliano.

©2024 Bloomberg L.P.