Oct 24, 2019

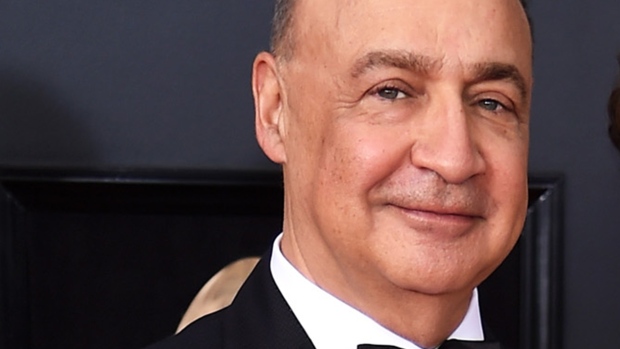

Billionaire Len Blavatnik Seeks to Raise $500 Million for DAZN

, Bloomberg News

(Bloomberg) -- DAZN, a sports streaming service owned by billionaire Len Blavatnik and led by former ESPN President John Skipper, is seeking to raise at least $500 million, according to people familiar with the matter.

The funds will mostly likely be used to support DAZN’s expansion efforts. The subscription service launched in Germany and Japan in 2016, entered the U.S. market in 2018 and now operates in nine countries. Earlier this year, the company doubled its monthly price in the U.S. to $20.

DAZN has spent lavishly to acquire sports broadcast rights, including a $1 billion partnership with Matchroom Boxing and a $365 million deal with boxer Canelo Alvarez, which was at the time with the richest single-athlete contract in sports history. Goldman Sachs Group Inc. is working on the fundraising, according to two of the people, who asked not to be identified because the matter is private.

Up to now, DAZN’s expansion has been supported by Blavatnik, who is worth $25.5 billion, according to the Bloomberg Billionaires Index. The fundraising effort may be a sign that he is no longer willing to solely carry the cost of broadcast rights.

DAZN (pronounced “da-zone”) has grown quickly by spending a lot in a short amount of time. In 2016, for example, the company quickly committed $3 billion to media rights in Japan -- including local soccer and baseball, Major League Baseball, the National Football League, all five major European soccer leagues and the Champions League.

The company declined to comment.

With many sports rights in the U.S. locked down in long-term deals, DAZN took a different tack there by trying to dominate boxing. It later added an MLB whip-around show, paying about $300 million over three years.Based in London, DAZN has been mentioned as a possible bidder for future rights to major U.S. sports leagues, including the National Football League.

DAZN began as part of Perform Group Ltd., a London-based company Blavatnik formed in 2007. Perform acted as a middleman for content, buying rights to games and data from sports teams, and packaging them for broadcasters.

The businesses were separated, and Blavatnik sold Perform earlier this year to Vista Equity Partners.

To contact the reporters on this story: Scott Soshnick in New York at ssoshnick@bloomberg.net;Eben Novy-Williams in New York at enovywilliam@bloomberg.net;Ira Boudway in New York at iboudway@bloomberg.net

To contact the editors responsible for this story: Nick Turner at nturner7@bloomberg.net, Rob Golum, John J. Edwards III

©2019 Bloomberg L.P.