Nov 15, 2018

Bitcoin extends rout after cryptocurrencies plunge 12%

, Bloomberg News

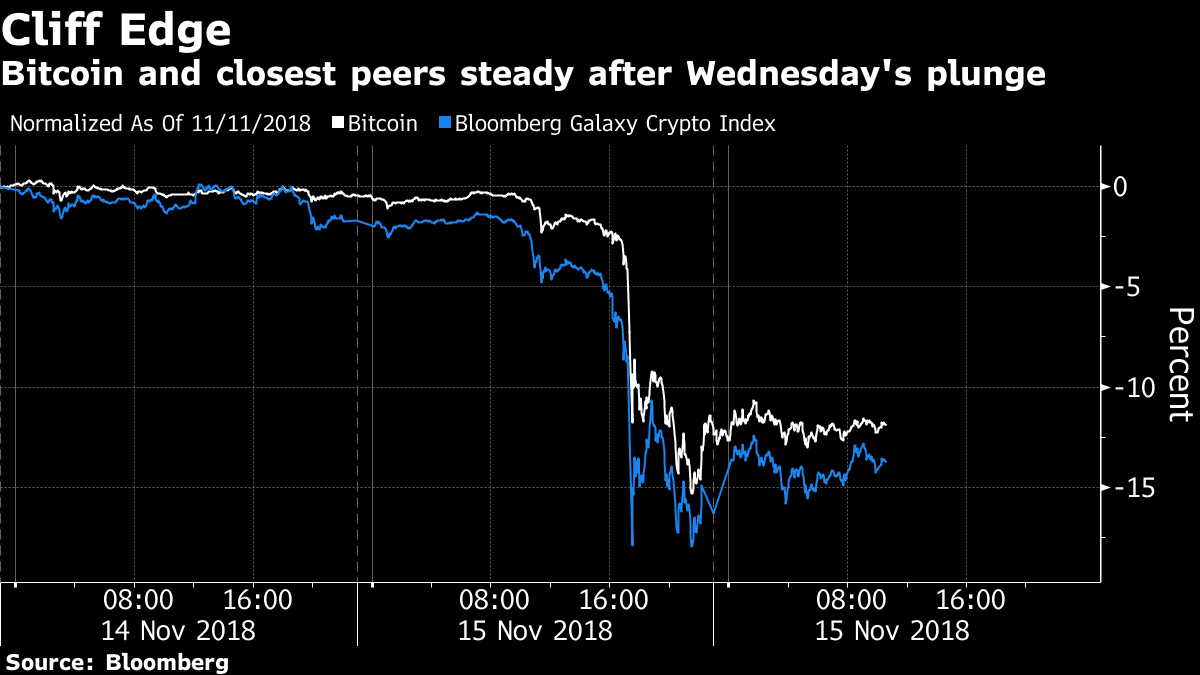

Bitcoin continued its slump after losing 12 per cent Wednesday and triggering the biggest cryptocurrency sell-off since February.

The 10-year-old token fell 3.4 per cent to US$5,362.96 as of 10:30 a.m. in London after it plunged through a key resistance level.

Many of Bitcoin’s closest peers also slid Thursday, while Bitcoin Cash, which will split today into two coins, rose 1.5 per cent.

As the dust settled a day after the Bloomberg Galaxy Crypto Index’s 15 per cent tumble, speculation over its causes includes today’s debut of the new version of Bitcoin Cash. Traders are mulling whether the coin, which itself broke off the original Bitcoin in 2017, is sucking investment and miners away from the largest crypto.

“The Bitcoin Cash hard fork is proving far more destabilizing than initially thought as numerous competing factions muddy the landscape,” said Stephen Innes, head of trading for Asia Pacific as Oanda Corp.

Oanda’s Innes said the disruption over the new Bitcoin Cash fork has created too much “noise” that triggered a “when in doubt get out´´ cause and effect. He said an eventual break below $5,000 for Bitcoin “opens the door to a test of US$2,500 as Bitcoin retail traders move from buying on dip to full-out panic mode.”