Mar 25, 2019

Bitcoin nears overbought territory after flirting with US$4,000

, Bloomberg News

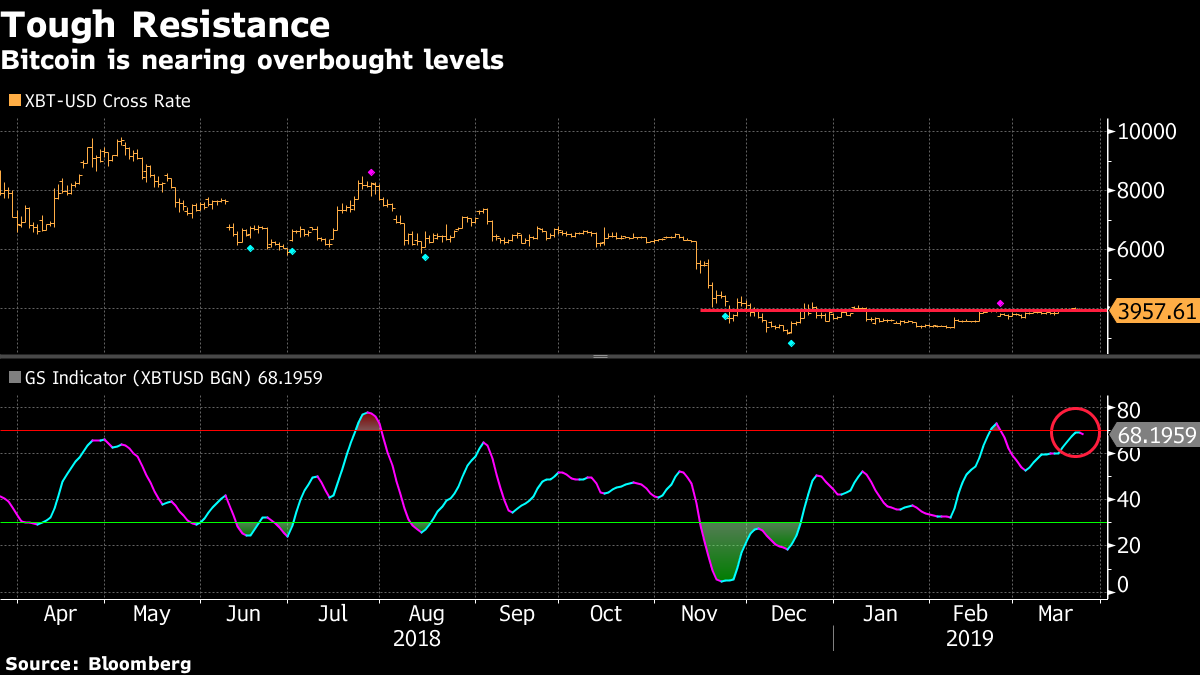

After Bitcoin struggled to maintain positive price momentum, a technical gauge is suggesting more pain in the coming weeks.

The original cryptocurrency briefly breached US$4,000 last week for the first time during weekday trading in more than two months, before falling back. Bitcoin is nearing overbought levels, according to the GTI Global Strength Indicator, a technical tool that accounts for intraday volatility. It could see further downside should it decisively break into that territory, the measure suggests.

Bitcoin followed a similar pattern in February when it breached into the overbought zone and lost about 3 per cent during the subsequent two weeks. The token has waffled between gains and losses this year, mostly trading above US$3,800. Bitcoin fell about 0.3 per cent to around US$3,967 as of 11:25 a.m in New York.

“We are due another retest of the lows,” said George McDonaugh, chief executive of KR1, a London-based blockchain technology investment company. “Normally, a market tries more than once to test the depths of despair and so far we’ve only had one clear test, which hit around the US$3,100 level.”

--With assistance from Kenneth Sexton