Feb 12, 2020

Bitcoin's break through US$10,000 puts new resistance in sight

, Bloomberg News

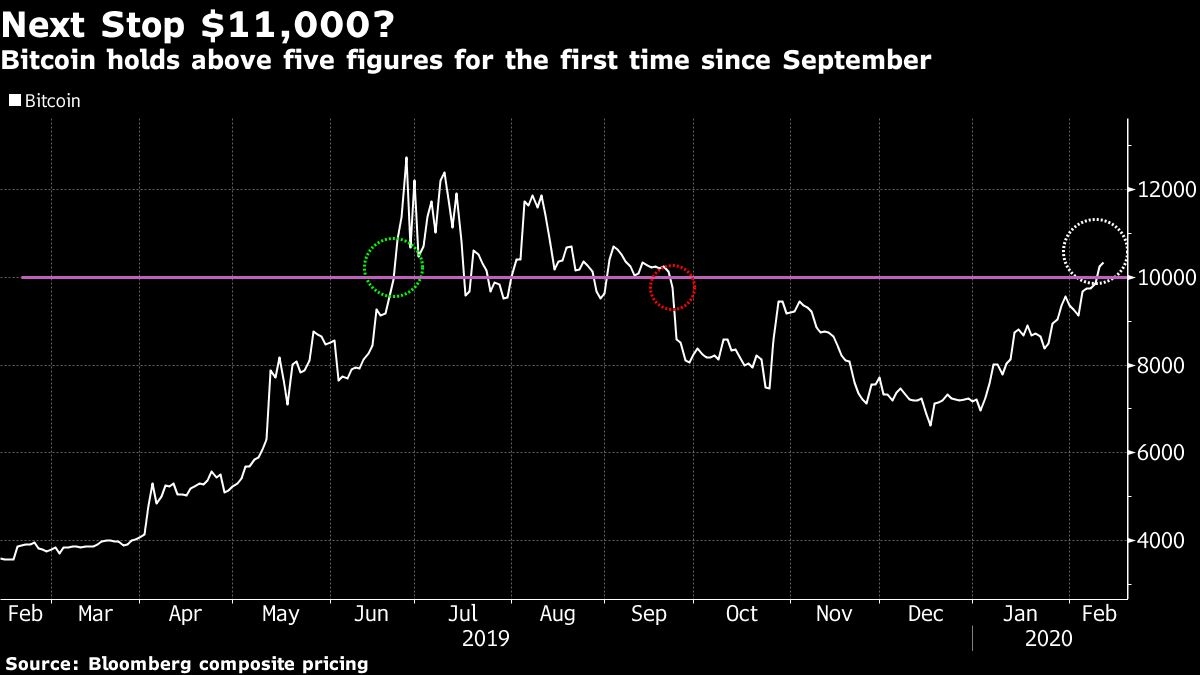

Bitcoin appears to have decisively breached US$10,000 for the first time since September, and now traders are setting their sights on the next resistance level.

The longest surge for the digital coin since June brought it to as high as US$10,481 on Wednesday. It was 1.2 per cent higher at US$10,353 as of 11:23 a.m. in London, heading for a sixth day of gains.

“It seems to move in clips of [US]$1,000,” Craig Erlam, senior market analyst at Oanda Corp. in London, said in an interview. “So if it it holds above US$10,000, then US$11,000 starts to look very interesting to me.”

The most-traded form of private money is frequently touted by enthusiasts as a haven asset, but its correlation with gold or Treasuries is poor. The current rally in fact coincides with a global equity benchmark near a record-high, and a mild decline in investment grade debt. With no underlying fundamentals to plumb, Bitcoin investors are often left studying technical trends.

Trading has tended to accelerate when the token climbs toward the five-figure mark. During the February rally, trades clustered between US$9,750 and US$9,850. Orders then fell off as it reached US$10,000 as buyers seemed to wait for evidence of fresh momentum.

“A break above [US]$11,000 would be an even more bullish action for me than this one above [US]$10,000,” Erlam said.