Feb 27, 2023

Bitcoin’s Fizzling Two-Month Rally Holds a Warning for Investors

, Bloomberg News

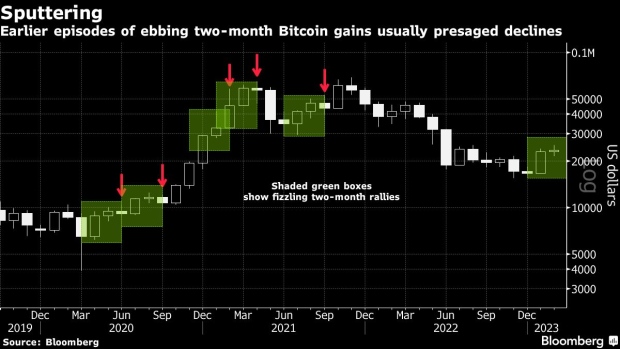

(Bloomberg) -- Bitcoin’s subsiding two-month rally contains a warning for investors if history is any guide.

The February jump in the largest digital token has withered to about 2% and pales compared to January’s 39% surge, data compiled by Bloomberg show.

There have been five similar instances since the pandemic low in 2020 when Bitcoin climbed over two straight months but with a smaller gain in the second stanza. It retreated in the third month in four of those cases, posting an average loss of 5.8%. The only exception was a period through February 2021, when the token was in the midst of a powerful bull run.

Bitcoin ended in the red Sunday for the third week in four, hurt by the prospect of higher-for-longer interest rates to damp inflation. A regulatory clampdown in the US after the collapse of the FTX exchange is also squeezing the sector — the latest development is a Securities and Exchange Commission probe of Robinhood Markets Inc.’s cryptocurrency business.

- Read more: Robinhood Subpoenaed by SEC Over Crypto Business

“It’s not surprising the market saw some correction” last week, wrote Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, who cited in part dollar strength amid bets on higher borrowing costs.

Bitcoin edged up 0.5% as of 7:55 a.m. in Singapore on Tuesday to trade at roughly $23,500. Ether, the second-largest cryptocurrency by market value, added 0.4% to reach $1,634.

While Bitcoin could stabilize near its 50-day moving average around $22,600, other trends suggest a “bearish short-term bias” is appropriate, Katie Stockton, founder of Fairlead Strategies LLC, a research firm focused on technical analysis, wrote in a note.

SOL, the native token of the Solana blockchain, has struggled this week with a decline of almost 3%. Solana suffered an hours-long slowdown over the weekend — the latest in a series of outages, technical issues and processing problems that has plagued the network since its debut in 2020.

- Read more: Solana Blockchain Hit by Hours-Long Network Slowdown

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

--With assistance from Chris Bourke.

©2023 Bloomberg L.P.