Apr 2, 2019

Bitcoin surges as crypto market suddenly springs to life

, Bloomberg News

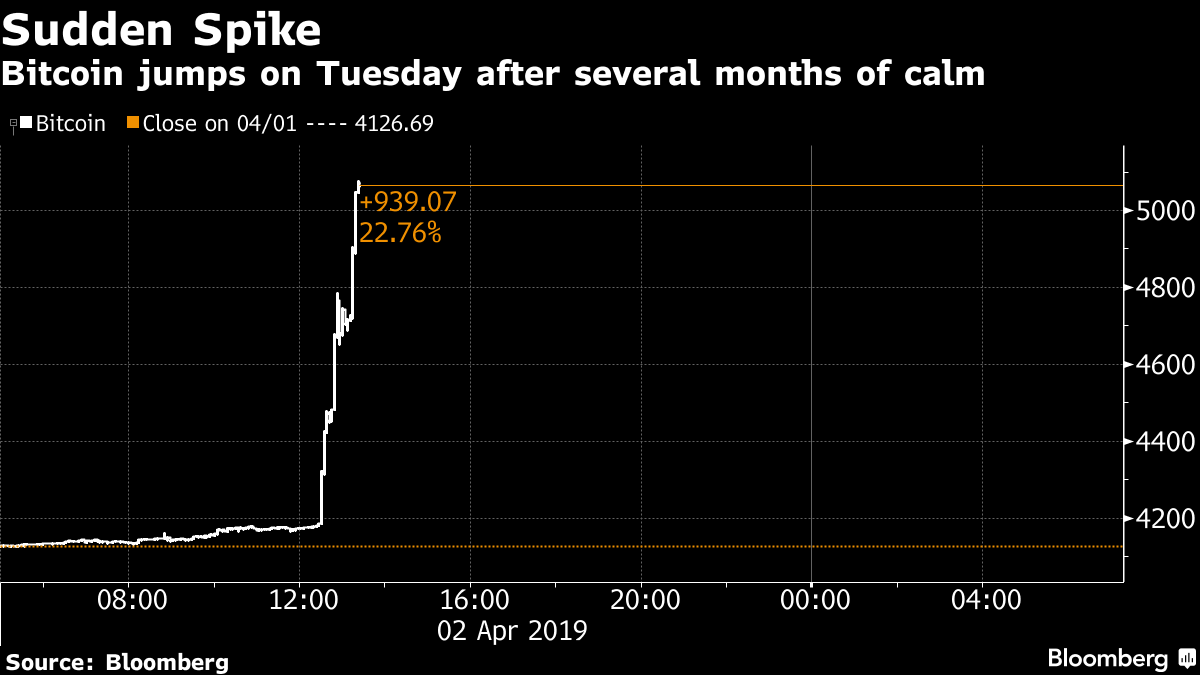

An abrupt surge in Bitcoin sent the world’s most popular cryptocurrency to the highest level since November, jolting the US$160 billion market for digital assets after three months of calm.

Traders struggled to pinpoint reasons for the rally, though some noted a flood fresh interest after Bitcoin breached the US$4,200 level. The cryptocurrency briefly topped US$5,000 and the value of digital assets tracked by CoinMarketCap.com jumped by about US$17 billion in less than an hour.

Sudden swings in Bitcoin are nothing new, but price action had been relatively subdued this year as investors weighed the prospects for mainstream adoption after last year’s 74 per cent crash. Market participants say big buy orders in Bitcoin can often lead to outsized moves, in part because volume is spread across dozens of venues. Trend-following individual investors and short covering can also exacerbate volatility.

“The Bitcoin market and crypto market in general continues to be small relative to the rest of the markets -- and emotional,” said Jehan Chu, managing partner at blockchain investment and advisory firm Kenetic Capital. “It’s still very much subject to waves of enthusiasm. I don’t think today is anything special.”

Even after paring some of its gain, Bitcoin was trading up 15 per cent at US$4,737.59 as of 11:35 a.m. in New York. Rival coins Ether, Litecoin and Bitcoin Cash jumped by double digits. Cryptocurrency-linked stocks including Remixpoint Inc. and CMC Markets Plc advanced.

George Harrap, chief executive officer at Bitspark, said he’s putting “most things on pause” until the market settles down. His contacts in the Bitcoin community have yet to identify a catalyst for the sudden jump.

“The reason why? Anybody’s guess at the moment,” Harrap said.

Among potential triggers discussed on trading desks and in social media: short covering by traders who had stop-loss orders around the US$4,200 level, computer-driven trading and an April Fool’s Day story on a little-known online news site claiming that the U.S. Securities and Exchange Commission had approved Bitcoin exchange-traded funds.

“Bitcoin is still primarily retail-led,” said Craig Erlam, senior market analyst at Oanda Corp. in London. “It’s still a relatively unsophisticated area of trading,” giving more credence to breaking the US$4,200 level than an April Fool’s hoax.

The cryptocurrency’s susceptibility to wild price swings has made it popular among speculators, who are eager for a return to the glory days of 2017 when Bitcoin surged more than 1,400 per cent.

Yet extreme volatility is also one reason why the virtual currency has failed to catch on as a global medium of exchange, as intended by its pseudonymous creator. Erratic moves have also deterred institutional investors, whose concerns about cryptocurrencies range from uncertain regulation to exchange hacks and market manipulation.

One research report last month asserted that most of the trading volume on the world’s largest cryptocurrency exchanges is questionable. A separate report said trading is often inflated by unregulated platforms.

“Events such as today’s will probably be seen negatively, or viewed as this market doesn’t conform to the trading of traditional instruments,” said Dave Chapman, CEO of crypto exchange ANXONE. “We have to realize that this asset class is only a decade old, and it only started getting mainstream attention five years ago.”