Feb 26, 2024

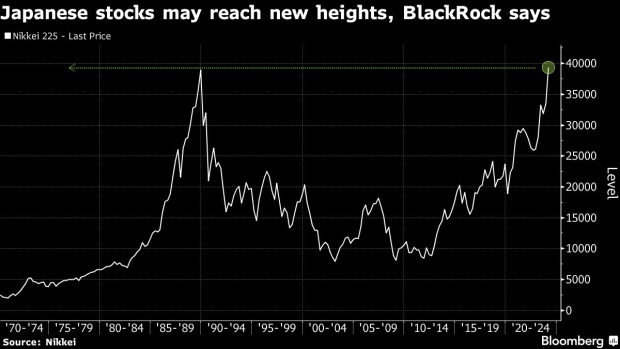

BlackRock Says Japanese Stocks Can ‘Best Their All-Time Highs’

, Bloomberg News

(Bloomberg) -- Japan’s equity rally has room to run, with robust earnings and corporate reforms among catalysts that will spur further gains, according to strategists at BlackRock Investment Institute.

“We think both the macro outlook and company-level developments will drive the next leg,” the team led by Jean Boivin and Wei Li wrote Monday in weekly market commentary, reiterating an overweight recommendation on Japan’s equities. Shares can “best their all-time highs,” the report said.

Japan’s Nikkei 225 Stock Average has extended gains since surpassing an all-time high last week. The broader Topix is near its own record, outperforming most major stock markets in US dollars this year.

The blue-chip Nikkei 225 gained momentum this week after Warren Buffett wrote in a letter to investors that major Japanese trading houses follow shareholder-friendly policies that are “superior” to those practiced in the US.

While the yen’s weakness has helped the value of corporate earnings made abroad, the market’s outlook also remains positive because higher inflation is letting firms raise prices and protect margins, as wage growth fuels consumer spending, according to BlackRock. Corporate governance reforms are also a “key driver” of the rally with Tokyo Stock Exchange pushing firms to improve their profitability and return money to shareholders.

The Bank of Japan is expected to prudently wind down ultra-loose monetary policy to avoid disrupting the exit from decades of no inflation, the note said.

©2024 Bloomberg L.P.