Apr 8, 2024

Blackstone-Backed Hedge Fund Antara Freezes Illiquid Assets

, Bloomberg News

(Bloomberg) -- Antara Capital, a $1.3 billion hedge fund backed by Blackstone Inc., froze its hard-to-sell assets from redemptions after piling on losses.

Money plowed into illiquid private investments has been withheld from redemptions and was placed in a so-called side pocket in February, after the firm posted a second straight year of slumping returns, according to people with knowledge of the matter. The move is aimed at avoiding a fire sale of those investments, which drove declines in the hedge fund’s performance in 2023.

A representative for Antara declined to comment.

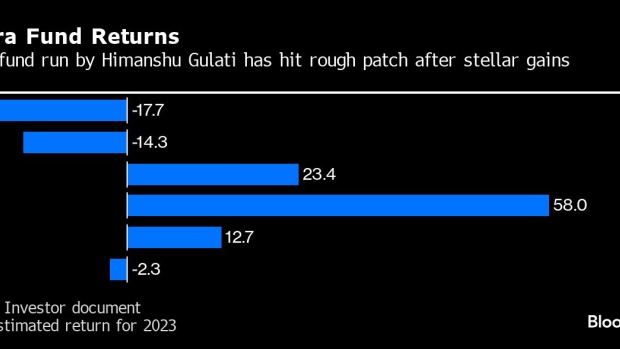

The main fund fell 14% in 2022 and lost an estimated 18% for 2023, according to a full-year update sent by the firm. The fund would have reported gains for 2023 excluding the private investments, and more than 80% of the investors consented to the creation of the side pocket, one of the people said.

Hedge funds with varied mandates had been chasing private investments in a frothy market before receiving a rude jolt as sentiment soured. Many investors are having to reassess the real value of those assets, forcing them to mark down their non-public market holdings.

Antara was founded by Himanshu Gulati, who previously helped run the distressed credit business at Man GLG, and started trading in 2018. Blackstone Inc. provided Gulati with $150 million for his new hedge fund, Bloomberg has previously reported. Despite two straight years of losses, investors who have been with Antara since inception have recorded gains of over 50%.

The firm’s name leans on the Sanskrit word for “opportunity.” Antara had told investors it provides equity-like returns with credit-like downside protections.

In 2021, Gulati struck a partnership with former Yankees star Alex Rodriguez’s investment firm ARod Corp. to form a special-purpose acquisition vehicle that would focus on targets in the sports, media, entertainment, health and wellness and consumer technology sectors, according to its listing documents.

Side pockets are investment vehicles that emerged from the depth of the financial crisis in 2008 after hedge funds got trapped in an avalanche of illiquid assets. Investors estimate that $200 billion to $360 billion were side-pocketed in 2008 — or as much as 20% of the industry then. While the vast majority of those side pockets have been unwound, some can linger on for much longer than initially anticipated.

©2024 Bloomberg L.P.