Feb 3, 2023

Blockbuster Jobs Report to Push Fed to Hike and Keep Rates High

, Bloomberg News

(Bloomberg) -- January’s blockbuster US jobs report is likely to strengthen the Federal Reserve’s determination to raise interest rates above 5% and keep them high throughout the year — an outcome investors remain skeptical of.

Fed Chair Jerome Powell on Wednesday said policymakers expect to deliver a “couple” more interest-rate increases before putting their aggressive tightening campaign on hold, though he didn’t push back strongly against markets pricing just one more hike and cuts by the end of the year.

“The number today on the jobs report was a wow number,” San Francisco Fed President Mary Daly said in an interview on Fox Business Friday, after the data showed job gains far above expectations while unemployment fell.

The Fed’s December rate forecasts, which showed a median estimate of about 5.1% at the end of 2023, were “a good indicator of where policy is at least headed, but I’m prepared to do more than that if more is needed,” Daly said.

The Federal Open Market Committee raised its benchmark rate by a quarter percentage point to a range of 4.5% to 4.75% this week. The smaller move followed a half-point increase in December and four jumbo-sized 75 basis-point hikes prior to that.

“Such a strong employment report probably means at least two rate hikes of 25 basis points, and I wouldn’t dismiss the possibility of a 50 basis-point hike returning on some Fed officials’ radar screen for the next meeting,” said Thomas Costerg, a senior US economist at Pictet Wealth Management in Geneva, Switzerland.

Powell, speaking to reporters Wednesday, welcomed recent lower readings on inflation that have brought it down from last year’s peak.

But he also voiced concern over a lack of progress in prices in the services sector outside of housing, which he has said is driven in large part by a tight labor market. The chair cited a ratio of 1.9 job openings for every unemployed worker, near a historic high.

“Dust off those hawkish playbooks, again,” said Derek Tang, an economist at LH Meyer in Washington. “Now markets have to resuscitate the right tail of outcomes and whether the Fed has to hike above 5.1%.”

Seventeen of 19 policymakers in December forecast rates rising above 5% this year, to a median of 5.1%, with policy staying on hold through the rest of the year.

Investors reacted to the hot January employment report by lifting expectations for how high rates will go. But they still see them peaking lower — 5.02% — followed by modest rate cuts by end-2023.

Higher Peak

“These data call into question the market narrative that disinflationary forces will position the Fed to start cutting rates in the second half of 2023,” said Jonathan Millar, a senior economist at Barclays Plc in New York. “At a minimum, the Fed will still be inclined to message ‘higher for longer,’ but risks of a higher peak rate have risen today as well.”

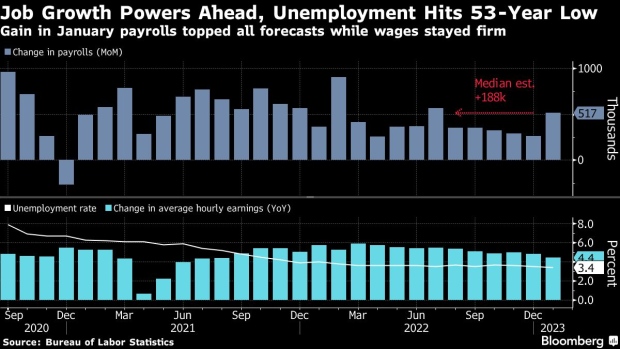

Nonfarm payrolls increased 517,000 last month – more than twice the expectations of Wall Street — after an upwardly revised 260,000 gain in December, a Labor Department report showed Friday. The unemployment rate dropped to 3.4%, the lowest since May 1969 and average hourly earnings grew at a steady clip.

Morgan Stanley economists led by Ellen Zentner, who had been predicting the Fed now would pause rate hikes, revised their forecast Friday to include another quarter-point increase. There’s “more upside risk if labor market data continue to move from strength to strength,” they wrote in a client note.

Michael Feroli, an economist at JPMorgan Chase & Co., raised his forecast, adding another quarter-point hike in May, and now calls for rates reaching 5%-5.25%.

Wage Gains

The Fed has sought to ease wage gains to a level consistent with its 2% inflation target. The jobs report showed average hourly earnings rose 0.3% from December and were up 4.4% from a year earlier, yet the prior month was revised higher.

Looking at a three month average, “wage gains have been a bit stronger,” Omair Sharif of Inflation Insights wrote in a report.

Other signals on wage pressures have been more benign, including a moderation in a closely-watched quarterly measure of employment costs, which rose 1% in the fourth quarter, which was slightly less than expected.

“We expect the Fed won’t take any signal from this wage data, and will await the more reliable employment cost index, due April 28, in determining its next steps,” said Anna Wong, chief US economist at Bloomberg Economics. She estimated “the underlying pace of wage growth is still 4%-5%, substantially higher than what’s consistent with the Fed’s price target.”

While the jobs figures showcase the resilience of the job market, Fed officials have said their goal is to reduce US growth to below its long-term trend to ensure price pressures are brought back down to levels that existed prior to the Covid-19 pandemic.

The Fed’s “main concern is they’re not yet seeing the impact of their tightening in the labor markets,” Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., said on Bloomberg Television. “This is a reminder of what Powell tried to say, but the market wasn’t listening.”

Financial conditions have eased the past few months as markets had started to price in a less aggressive Fed, even as policymakers insisted rates would stay higher for longer.

US stocks fell and Treasury yields shot higher after data showed a tight labor market that could undermine the Fed’s efforts to slow inflation.

“Chairman Powell left the meeting saying ‘we will see’” Costerg said. “Well, after this nonfarm payrolls report, it’s FOMC 1-Markets 0.”

--With assistance from Christopher Anstey.

(Updates with comments by Fed’s Mary Daly in the third paragraph.)

©2023 Bloomberg L.P.