Dec 13, 2023

BofA’s European Forecasters Clash on Equity Outlooks for 2024

, Bloomberg News

(Bloomberg) -- A disagreement is brewing between Bank of America Corp.’s European stock market analysts and strategists.

The lender’s analysts who issue buy, hold and sell recommendations anticipate solid gains and expect corporate earnings to rebound 8% next year, underpinned by robust margins and resilient demand.

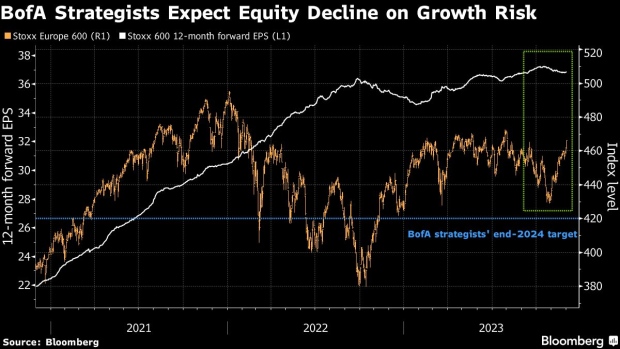

That contrasts with the view held by BofA’s equity strategists led by Sebastian Raedler, who expect a sputtering economy to tank stocks next year. They say weakening global growth and the impact of central bank rate hikes will crimp profits.

“After a year of upside surprises to global growth, we expect economic gravity to reassert itself in 2024,” Raedler wrote in his outlook note for next year.

The BofA analysts’ price targets suggest stocks covered by the bank could rise by 15%, according a note dated Dec. 13. On the other hand, Raedler’s team — which takes a macro approach in forecasting market behavior — expects the Stoxx 600 to sink by mid-2024 before recovering in the second half. Overall, his year-end target of 420 points suggests a drop of 11% from current levels.

It’s not unusual for single-stock analysts to be more optimistic as they take their cues primarily from company guidance. Overall, analysts expect European earnings to bounce about 6.5% in 2024, according to data compiled by Bloomberg Intelligence.

Top-down strategists have remained cautious after their call for subdued gains this year was left in the dust by a 12% rally in the Stoxx 600. The group is sticking to its gloomy view for 2024 by forecasting almost no upside for the Stoxx 600, a Bloomberg poll of 16 strategists showed this month.

Raedler, in particular, was one of the most pessimistic voices this year as he expected a slowing economy to damage stock returns.

©2023 Bloomberg L.P.