Jan 11, 2024

BofA Strategists See Bigger Currency Swings as Fed Cuts Rates

, Bloomberg News

(Bloomberg) -- Currency markets will become more volatile this year as the Federal Reserve starts cutting interest rates, according to strategists at Bank of America Corp.

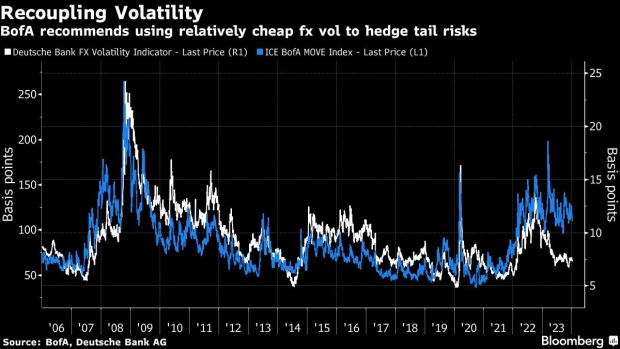

They’re telling clients to buy FX options, which will become more valuable with bigger market swings. Strategists including Bruno Braizinha also highlight an unusual gap between the ICE BofA MOVE index, a measure of Treasury market volatility, and CVIX, which tracks expectations for currency swings, and argue that the two indexes are bound to converge.

“The role of rates as the main shock absorber is likely to fade over ’24 as the Fed starts to deliver on policy easing,” they wrote in a note. “FX vol may take some of that mantle from the rates space.”

Because currency markets have been subdued, options on FX pairs are relatively cheap, making them a good bet for investors looking to hedge their portfolio. The Bank of America strategists also said FX volatility tends to rise when the Fed starts cutting rates and investors may want to protect against US election risk.

“We see scope for clients to express these tail hedges in relatively cheap FX vol space,” they said.

©2024 Bloomberg L.P.