Apr 28, 2023

BOJ’s Ueda Scraps Guidance on Rates, Calls Review, Holds Policy

, Bloomberg News

(Bloomberg) -- The Bank of Japan scrapped its guidance on future interest rate levels while keeping its main stimulus measures unchanged, as Governor Kazuo Ueda prepared the ground for taking a more flexible stance on policy.

The BOJ maintained its rock-bottom interest rate and asset purchase settings at the end of a two-day gathering Friday, as expected by almost 90% of economists surveyed by Bloomberg.

The central bank also called for a long-term review of its policies and issued new price forecasts that show inflation below 2% again in the fiscal year ending March 2026.

The decision to keep stimulus in place in pursuit of stronger inflation keeps the BOJ in a very different place to its price-fighting global peers for now.

While the wave of policy tightening around the world to weaken inflation appears close to peaking, the Federal Reserve still looks set to push up borrowing costs further when it meets next week.

That possibility still seems a long way off for the BOJ, given a reiterated commitment in Friday’s statement to continue easing with yield curve control.

Still, Ueda later clarified that policy could be changed including a normalization during the review process.

“We’re not starting the review with the aim of normalizing,” Ueda said. “But it’s not zero chance we begin normalizing during the review period.”

For now, the risk of a premature tightening move stopping the BOJ from achieving its price target is greater than the cost of a delayed move, he said.

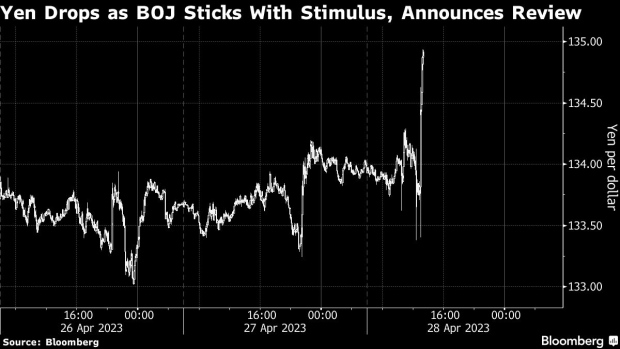

Japan’s currency weakened more than 1% against the dollar to around the 135.80 level and 10-year government bond yields slumped below 0.4% while Ueda was speaking. Japanese bank shares finished the day modestly lower, despite a rise in Tokyo stocks overall.

“This result certainly fits closer to what the market was expecting in terms of echoing patience and restraint,” said John Bromhead, strategist at Australia & New Zealand Banking Group Ltd. in Sydney.

Yen Seen Coming Under More Pressure as Strategists React to BOJ

Still, dropping the rates guidance and calling for a policy review show Ueda intends to get the ball rolling under his leadership, even as he spurned the chance to make a regime-change start like his predecessor Haruhiko Kuroda.

Around a quarter of polled economists had seen the BOJ updating its guidance at this meeting while making clear its intention to stick with easing.

Many of them said the reference to Covid-19 in the guidance seemed outdated given the recent recovery from the pandemic, and a upcoming decision by Prime Minister Fumio Kishida’s government to downgrade the virus to the same status as flu.

By also ditching the explicit possibility of cutting short and long-term rates, Ueda likely secured the central bank more room for maneuver going forward. The reassurance that YCC would continue served to offset the possible hawkish interpretation of the move, as Ueda, the originator of forward guidance at the BOJ decades ago, looked to revise it without upending markets.

“If the BOJ remained too constrained by the yield target in its forward guidance it could have made it difficult to make adjustments going forward,” said Harumi Taguchi, principal economist at S&P Global Market Intelligence. The removal of the rates guidance has increased the BOJ’s scope for flexibility, she said.

The review of monetary policy will take place over a year to a year and a half. The longer time frame comes in sharp contrast with past assessments that were conducted over just a few months, and fueled speculation of looming policy change.

While some economists saw the review as likely to push back policy change, others drew different conclusions, with smaller tweaks within the overall concept of easing still possible in coming months.

“There is still a good chance of YCC adjustment in June or July because uncertainties over the global economy are likely to intensify in the second half of this year due to tightening by the Fed and European Central Bank,” said Tetsufumi Yamakawa, head of Japan research at Barclays and a former BOJ official.

“Unless the BOJ moves early, it will miss the window of opportunity and make its easing framework even more unsustainable,” he added.

What Bloomberg Economics Says...

“A shift in forward guidance to a more neutral stance gives Bank of Japan Governor Kazuo Ueda more flexibility to adjust policy ahead. The hold at the two-day meeting that ended Friday — Ueda’s first as BOJ chief — was well flagged.”

— Chang Shu, Chief Asia Economist

To read the full report, click here.

Still, there was plenty in Ueda’s comments to suggest that the BOJ will initially move slowly.

In a new quarterly outlook report, the BOJ projected core prices to rise just 1.6% in fiscal 2025, a forecast that largely supports the bank’s view that it has yet to achieve lasting 2% inflation. Economists had flagged ahead of the decision that any figure showing 2% or more would have fueled speculation of policy adjustment.

The BOJ also said the risks to that inflation view in fiscal 2025 are skewed to the downside, another element that suggested the bank would not be rushing to change policy even if it is now better placed to do so.

For now market players interpreted the decision as largely more supportive of stimulus than expected, as indicated by the currency and bond moves. Trader focus will now shift stateside to next week’s Fed meeting.

“With Fed meetings coming up, the BOJ’s comfort with a weaker yen could once again be tested,” said Aninda Mitra, head of Asia Macro & Investment Strategy at BNY Mellon in Singapore. “We wouldn’t be surprised to see the yen to go toward 140 per dollar in coming days and weeks.”

--With assistance from Ruth Carson, Cormac Mullen, Yoshiaki Nohara and Yuko Takeo.

(Adds comments from Ueda press briefing)

©2023 Bloomberg L.P.