Jan 23, 2022

Bond Meltdown Haunts Australian Central Bank as Inflation Builds

, Bloomberg News

(Bloomberg) -- Australian bond yields are primed to set new highs as bets that the central bank will scrap quantitative easing reach a crescendo ahead of a pivotal inflation report.

Traders are girding for the risk of fresh turmoil, with unemployment’s drop to a 13-year low raising the prospect of a sharper-than-expected spike in consumer price data on Tuesday. The last set of CPI figures in October sparked a market meltdown that saw the Reserve Bank abandon its yield control policy.

With the Federal Reserve poised to ratchet rates higher, investors in Australia’s $620 billion sovereign bond market are trying to gauge if the RBA will end its QE program as soon as its Feb. 1 meeting. If it does, there’s a greater likelihood of Governor Philip Lowe hiking rates this year too -- something he’s said won’t happen before 2023.

“An explicit decision to move to quantitative tightening is likely on the table for the February meeting,” said David Plank, head of Australian economics at Australia & New Zealand Banking Group Ltd. “The fourth quarter CPI report may be enough to seal it.”

Economists estimate the pace of consumer price gains for the trimmed mean -- the RBA’s favored measure -- to have reached 2.3% in the three months through December, versus its 2-3% inflation target.

Ahead of the release, here is a series of charts that show the renewed tension between Lowe’s dovish guidance and hawks in the bond market:

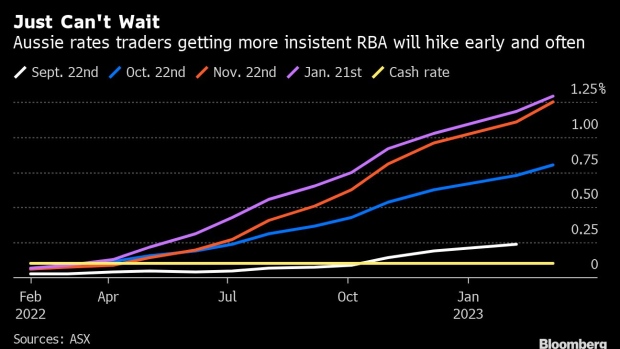

Traders are already betting the RBA will raise interest rates from a record low of 0.1% as early as May, and no later than June.

Most economists also doubt the central bank can hold to its current guidance, while suggesting that investors have gotten ahead of themselves.

The contrasting views of the RBA, economists and markets also point to another catalyst for market ructions: if CPI is unexpectedly weak and burns traders rather than egging them on to more aggressive positioning.

“Yields are biased to move higher in Australia and globally in the coming weeks, but only modestly given the extent of recent moves,” said Su-Lin Ong, senior economist and rates strategist at Royal Bank of Canada in Sydney. “The challenge for the RBA is to communicate to markets that the end of QE in February does not mean the start of a hiking cycle by mid year.”

While rising fuel and housing costs and supply-chain snarls caused by the spread of the omicron coronavirus variant are seen driving inflation at present, Lowe’s preference is to look past these disruptions.

“The RBA’s insistence to act on actual and not forecast data outcomes by definition means the bank is likely to remain behind the curve,” said Prashant Newnaha, an Asia-Pacific rates strategist at TD Securities in Singapore.

There are of other signs that monetary tightening may come soon, starting with an end to the near A$330 billion ($235 billion) QE program. The RBA bought more than three times as many bonds as the government sold last year, yet yields are elevated relative to other markets with AAA scores from all the major ratings companies.

There are also concerns that the RBA’s more than 32% stake in the market is creating distortions. Bonds loaned by the central bank surged to unprecedented heights this month amid seasonally slack liquidity and a decline in trading volumes for futures.

With the Bloomberg AusBond Treasury Index showing a 1.2% drop through Jan. 21, investors are wary of further selloffs.

“The inflation numbers could set off some very strong market moves,” said Sean Keane, managing director of Triple T Consulting Ltd.

©2022 Bloomberg L.P.