Oct 6, 2023

Bonds Backed by Subprime Auto Loans Shrug Off Soaring Delinquencies

, Bloomberg News

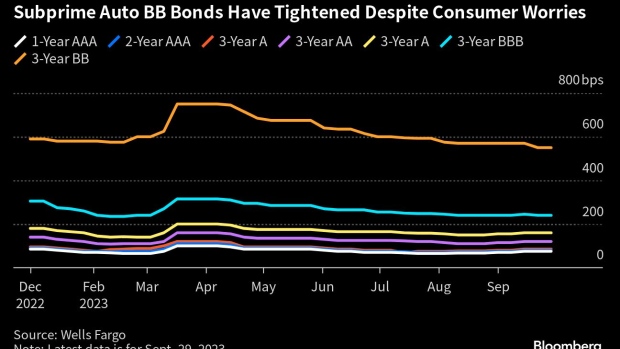

(Bloomberg) -- Spreads on the lowest rated bonds backed by subprime auto loans have fallen to the lowest in a year, part of a broader tightening of risk assets that until recently had pulled the corporate bond market tighter as well.

Spreads on BB rated subprime auto bonds were 550 basis points as of Sept. 29, two full percentage points below the levels they reached after Silicon Valley Bank and Signature Bank collapsed and in line with levels from last September, according to data from Wells Fargo & Co.

That’s despite growing concerns about how lower-income consumers will hold up as student loan payments resume, not to mention the fact that the share of subprime borrowers 60 or more days behind on their auto loans recently touched its highest ever, according to S&P Global Ratings.

Tightening spreads show that investors are less worried about consumers defaulting on their loans and are instead taking their cues from macroeconomic factors, such as the easing risk of recession, said Eugene Belostotsky, an analyst at Citigroup Inc.

“Notwithstanding volatility over the last month, risk assets have been rallying this year and spreads have been tightening,” said Belostotsky in an interview. “Relative to corporates, spreads on asset-backed securities are still relatively wide.”

Spreads in corporate bond markets were near the tightest levels of 2023 before backing off in recent weeks amid rates market volatility, according to Bloomberg indexes. The high-grade spread rose 11 basis points since Sept. 22 while junk bonds widened by 45 basis points during that time.

Subprime auto asset-backed securities are bundles of auto loans from lower-tier or “subprime” borrowers, typically with FICO scores of 620 or below. Interest payments from each of the borrowers in the pool are combined to form a single massive revenue stream, which is then used to repay bondholders.

Of course, spreads on the bonds might be tested by a recent sharp rise in Treasury yields and drop in stocks, a move that was exacerbated this morning after a jobs report showed surprisingly strong gains.

Even so, ABS that have priced so far this week have largely come in near where bankers initially pegged spreads. In contrast to Treasuries, asset-backed securities tend to be backed by loans with short maturities, and they’ve bypassed much of the upheaval that’s gripped the Treasuries market, where the longer portions of the yield curve have risen most.

Investors are “more cautious given the rate moves,” said Aoiffe McGarry, head of US asset-backed finance at Citigroup. Even so, she said, “The yields of short dated nature offerings are still relatively attractive compared to alternatives like corporate credit.”

Other Top Stories

- Mortgage Bonds Blow Up; Banks Feel Regulatory Heat: Credit Edge

- As Mortgage Rates Approach 8%, Coupon Stack Expands Further

- Millennium Hires Diameter’s Friedman to Run Credit and Mortgages

- Mortgage Bonds Slump Near Post-Crisis Record Amid Market Selloff

- Ineos Strikes Deal With Santander USA to Finance Auto Loans

- Mortgage Refi Borrowers 500bps Out of Money at New High: Brean

- JPMorgan Says ‘Esoteric’ ABS Gain Liquidity Yet Demand Varies

- Barclays Preaches Caution in CRE CLOs as Special Servicing Grows

- Redding Ridge Buys $2.8b of CLO Management Contracts

- CCC Loans Share in CLOs Rise to 8%; More Headwinds Looming: BofA

- Credit Risk Transfer Index Sees Highest Ever Return Through 3Q

Spreads Change

Relative Value

With macro risk assets selling off and rate volatility increasing again, there’s value in the liquidity profile of more benchmark assets, according to a note by Barclays dated Oct. 6.

- Within the whole business sector, the British bank favors less cyclical, benchmark quick service restaurant whole business securitization paper over non-benchmark WBS, “especially as the spread premium for non-benchmark paper has narrowed significantly post-SVB,” writes strategist Powell Eddins

- Meanwhile an upward revision by Barclays economists to estimated pandemic excess savings should be broadly supportive of consumer health

- “We believe it is a bigger benefit for consumer credit-related assets, as opposed to corporate-related assets, given risks to spending on the horizon”

What’s Next

First Investors, Santander, Tricolor and the Valley Strong Credit Union began premarketing subprime auto deals for next week. For the Valley Strong, it will be its first 144a offering of auto loan ABS. CarMax also plans to sell its fourth prime auto of the year. ABS-15Gs were also filed on Thursday by Gracie Point, Merchants Fleet Funding and Mercedes-Benz.

- To subscribe to the Structured Pipeline, click the gray bar in the upper left hand corner

--With assistance from Carmen Arroyo and Charles Williams.

©2023 Bloomberg L.P.