Mar 20, 2024

Bonds Rally After Fed Keeps 2024 Median Rate Forecast at 3 Cuts

, Bloomberg News

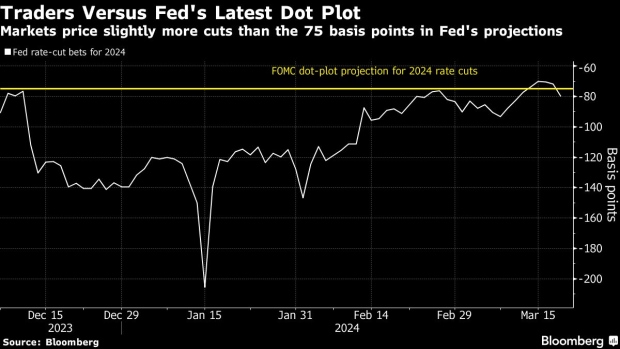

(Bloomberg) -- Short-maturity Treasuries jumped after Federal Reserve policymakers stuck with their forecast for three quarter-point interest-rate cuts this year, putting to rest market concern that the central bank would crimp plans to ease monetary policy.

Yields on two-year debt briefly declined to session lows after the Fed’s policy announcement Wednesday, and traders now see about 77 basis points of cuts this year, up from 73 before the release. Policy makers’ revised rate forecasts showed a median of 4.625% for the end of this year, unchanged from December, while projecting higher rates in the future. Longer-dated Treasuries fell in response.

The effective policy rate has been 5.33% since July, when the target band was set at 5.25%-5.5%, so the median for year-end is consistent with three quarter-point rate cuts.

“This seems more dovish than market anticipated with no change to the 2024 median dot,” said Zachary Griffiths, head of US investment grade and macro strategy at CreditSights.

Read more: Fed Dot Plot Offers Clues on Appropriate Pace of Change

Market-based measures of inflation-expectations moved higher after the decision, in part because officials lifted their outlook for price pressures in their quarterly forecasts.

Policymakers raised their 2024 forecast for underlying inflation to 2.6% from 2.4%, and boosted their growth forecast to 2.1% from 1.4%. They also lowered their unemployment rate projection slightly, to 4% from 4.1%.

Officials’ “projections are bullish-hawkish in that they are bullish on the economy — higher GDP/lower unemployment — and hawkish on inflation,” said Ben Emons, a senior portfolio manager at Newedge Wealth. “The Fed absolutely wants a soft landing.”

--With assistance from Kristine Aquino.

(Adds strategist comments and updates rates throughout.)

©2024 Bloomberg L.P.