Mar 2, 2021

Brazil Traders Start to Bet on Biggest Rate Hike in a Decade

, Bloomberg News

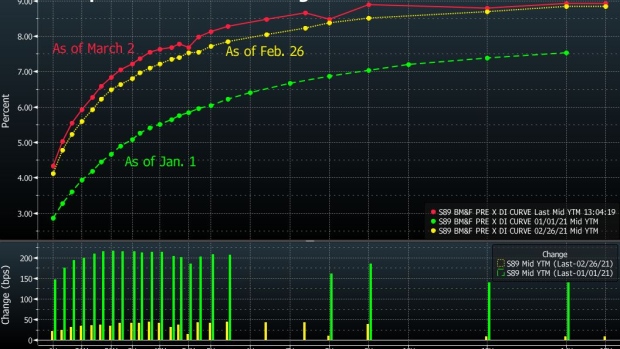

(Bloomberg) -- Brazil traders have begun to bet the central bank may deliver the most aggressive interest rate hike since 2010 as the sell-off in local assets deepened amid growing concern about the country’s fiscal outlook.

Swap rates, which were already fully pricing in a half-percentage point rate increase at the bank’s March 17 meeting, are now implying chances of an even bolder move, of 75 basis points.

“There’s a chance the scenario will deteriorate so much until the next meeting that a 50 basis point hike would seem dovish,” said Solange Srour, chief economist at Credit Suisse in Brazil.

The spike in rates followed a slump in the Brazilian real, which led losses among major currencies even as the central bank repeatedly stepped in to prop it up, including two spot dollar sales on Tuesday. The currency fell 1.3% as of 1:50 p.m. in Sao Paulo. Stocks dropped 1.6%, underperforming almost all major peers.

The selloff comes as a string of negative headlines turns investors more pessimistic on the outlook for fiscal accounts, the reform agenda and the impact of the pandemic on activity.

A continued rise in Covid-19 cases across the nation is threatening to push hospitals to a collapse, leading state governors to announce a fresh round of restrictions. That, in turn, is increasing pressure on congress to approve more financial aid to the poorest.

Discussions on a bill that would unlock the cash handouts are another source of worry to investors, who are concerned lawmakers will scrap planned compensatory fiscal measures to balance the impact of the additional spending.

“The selloff in both short-end rates and the currency is more related to risk premium and fiscal outlook uncertainty,” said Juan Prada, a currency strategist at Barclays in New York.

Investors are also fretting over whether Economy Minister Paulo Guedes will stay in office. While President Jair Bolsonaro publicly praised his economic czar last week, the Minister’s influence over the agenda has weakened amid the Covid crisis. Bolsonaro’s decision to replace the chief executive officer of Petrobras last month, and his announcement Monday of a cut on diesel and cooking gas prices have further fanned concerns over Guedes’s fate.

The Minister said in an interview that aired Tuesday morning he’d rather step down than take the government into the wrong direction. Brazil risks becoming Argentina in six months and Venezuela in a year and a half if it strays from austerity, Guedes said.

“With the flurry of risks in the horizon, news stories about Guedes remaining as the Minister of the Economy (or not), could disturb markets further,” Citigroup economists led by Dirk Willer wrote in a note. “Investor optimism will remain suppressed after the government’s meddling to prevent a rise in fuel prices, and the potential dilution of compensatory measures in the emergency bill.”

Rate Hike Bets

Swap rates soared on Tuesday, with the longer end of the curve up more than 20 basis points. That has led the curve to imply a 60 basis point increase in borrowing costs this month, which means the market is fully pricing in a 50 basis point hike and sees a 40% chance of a 75 basis point move.

The last time the central bank increased rates by that much was in mid-2010, amid a tightening cycle that pushed the Selic benchmark rate to 12.25%. Over the past few years, borrowing costs have consistently fallen, reaching the current all-time low of 2%.

While some investors say the recent move is exaggerated, consensus is growing that officials will have to deliver at least a half-percentage point hike in March.

“The window for a 25 basis point move has definitely closed,” said Bruno Carvalho, a fixed income trader at Asset 1 in Sao Paulo.

©2021 Bloomberg L.P.