May 31, 2023

Bud Light Sales Slump Has AB InBev Eyeing Worst Month Since 2020

, Bloomberg News

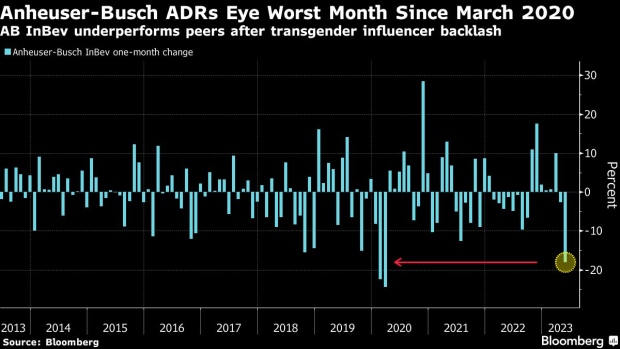

(Bloomberg) -- Anheuser-Busch InBev NV just recorded its worst month since the start of the pandemic as the backlash in the US over a decision to promote its Bud Light brand with a transgender influencer rages on.

The beer maker’s US-listed shares sank 18% in May, compared with the March 2020 plunge of 24% on the heels of widespread lockdowns in an effort to stop the spread of the Covid-19 virus. Meanwhile, rivals Boston Beer Co., Molson Coors Beverage Co. and Constellation Brands Inc. have all fared better than AB InBev this month, seeing an average return of 5.4%.

“It has been eight weeks since the start of the Bud Light controversy, and the saga continues,” Bernstein analysts led by Trevor Stirling and Nadine Sarwat wrote in a note Wednesday.

The backlash began the first week of April following a collaboration with Dylan Mulvaney, a transgender social media influencer. Since Mulvaney’s social media posts, Bud Light volumes have been hit “like a ton of bricks” and the volume declines have spread into AB’s other large brands, the analysts said, citing the latest third-party industry data from Nielsen.

Read more: AB InBev Falls as Data Shows Accelerating Bud Light Declines

The degree to which AB’s other brands, including Budweiser, Natural Light and Michelob Ultra, are also being hit is “surprising,” Stirling said. “The backlash is definitely worse than we expected and lasting longer than we expected.”

The controversy is also at risk of spilling over into a critical period for AB InBev. The third quarter, which begins in July, is normally AB’s largest in the US by revenue and volume. Rival offerings including Boston Beers’ Seltzer and Truly alcohol products and Constellation Brands’ Corona and Modelo Especial beers all stand to benefit if the boycott extends through the period, Roth MKM analyst William Kirk wrote in a research note.

“Corona and Bud Light overlap more in summer than the spring,” said Kirk, who upgraded both Boston Beer and Constellation Brands on Tuesday, citing expectations that the two will gain over the summer months from Bud Light losing market share.

Still, Stirling maintains an outperform rating on AB. The US market represents approximately 26% of AB’s global sales and 30% of total profits, he noted, adding that if volumes were down 15% and profits were down 30% in the US forever it would be about a 9% hit to global operating profits. Yet, AB US-listed shares are down 20% since the start of April.

“Even allowing for weak stock markets, this looks like an over reaction,” he said.

(Updates to reflect closing prices throughout story.)

©2023 Bloomberg L.P.