Jun 6, 2022

Bumper Wheat Crop Looming in Australia Set to Ease Tight Market

, Bloomberg News

(Bloomberg) -- Australia, one of the world’s largest wheat exporters, is forecast to produce another huge harvest this season as favorable conditions encourage growers to ramp up planting of winter crops to near-record levels.

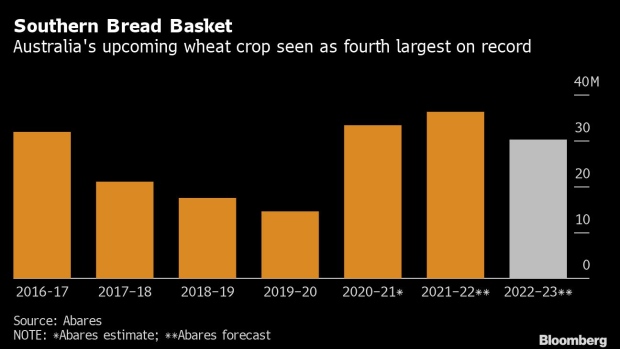

Wheat production is estimated at 30.3 million tons in 2022-23, or 22% above the 10-year average, according to government forecaster Abares. That would be the fourth largest on record and compares with an all-time high of 36.3 million tons in 2021-22, which Abares estimated in March. The canola crop is seen at 5.6 million tons, the second largest after 6.4 million tons the previous year.

High prices and supportive seasonal conditions are prompting more sowing of wheat and canola, with planted area for wheat rising 1% and for canola expanding 12% to a record, Abares said. The increase comes at the expense of barley in most states, and chickpeas in Queensland and North South Wales.

The outlook is more downbeat than some other forecasts, with Rabobank estimating wheat and canola crops at 32.5 million and 5.8 million tons -- figures it said were “conservative” because it was so early in the season.

Still, the prospect of more supply from Australia will be welcome news for global importers, after wheat prices hit a record following Russia’s invasion of Ukraine. The conflict has slashed exports of wheat and corn from the Black Sea -- an area which normally accounts for over 25% of global wheat shipments -- and driven up costs for vital farming inputs, such as fertilizer and diesel.

Adverse weather has hit production in other major growing regions, and global wheat stockpiles are forecast to drop to a six-year low in the coming season, the US Department of Agriculture said last month.

Other points from Abares:

- Wet conditions have likely delayed winter-crop planting in parts of Queensland and New South Wales, while access to farm labor and imported machinery remain persistent challenges nationally

- Global supply chain and shipping disruptions continue to be hurdles for the country’s export program, but “are not expected to meaningfully restrict exports”

- The value of agricultural exports is set to reach an all-time high of A$64.9 billion ($46.9 billion) in 2022–23, driven by record crop shipments due to high prices and a significant exportable surplus

- Fertilizer availability is not seen as a “significant issue” for 2022-23 winter-crop production, though yields in future seasons may be affected if prices remain high

- World wheat production is poised to shrink to 776 million tons in 2022–23 from 780 million tons a year earlier, leading to a drop in global wheat stockpiles; consumption and exports are expected to outpace supply in major exporting countries

- Global oilseed production is expected to rise 8% to 647 million tons in 2022–23, driven by larger soybean output in Brazil as well as increased canola production in Canada

©2022 Bloomberg L.P.