Aug 29, 2022

BYD’s First-Half Net Income Triples to Hit Top End of Forecast

, Bloomberg News

(Bloomberg) -- BYD Co.’s net income rose to the top end of guidance it gave last month as record output and sales shielded China’s biggest electric-vehicle maker from Covid disruptions and supply-chain pain.

Net income in the six months through June tripled from a year earlier to 3.6 billion yuan ($521 million), the Shenzhen-based company said in a filing Monday. BYD had forecast net profit of between 2.8 billion and 3.6 billion yuan.

China’s BYD Aims to Rule EV World by Being Anything But Tesla

Revenue was 150.6 billion yuan, up 66% from a year earlier thanks to record monthly sales. Analysts forecast revenue of 166 billion yuan, according to data compiled by Bloomberg.

BYD, which is backed by Warren Buffett, has managed supply-chain disruptions better than many others, including homegrown rivals Nio Inc., XPeng Inc, and Li Auto Inc. as it makes components such as batteries and semiconductors. The company also avoided the majority of Shanghai’s Covid lockdowns because it has factories elsewhere.

China’s Li Pledges to Keep Favorable EV Policies in BYD Visit

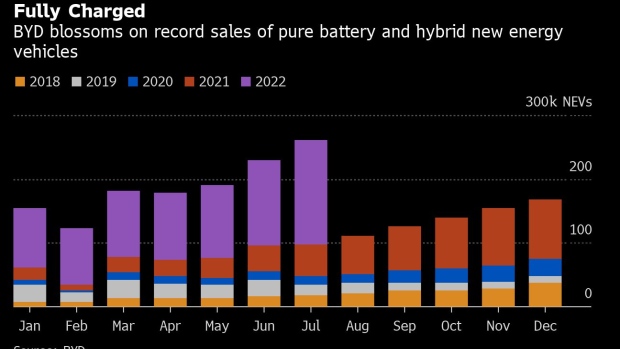

BYD sold more new energy cars in the first seven months of this year than in 2020 and 2021 combined. The group’s share of China’s NEV market reached 24.7% in the first half, the company said in Monday’s filing, citing data from the country’s automobile association.

The company listed challenges including Covid-19 and the conflict between Russia and Ukraine that pushed up commodity prices and slowed economic growth. Sporadic virus outbreaks in China aggravated supply-chain tensions and increased uncertainty, it said.

“China’s economy has seriously deviated from the normal track” and the development of the country’s automobile industry “has been severely compromised,” BYD said. Still, sales of NEVs are growing, helped by supportive government policies, it said.

Revenue from automobiles and related products rose 130% to about 109 billion yuan in the first half, while handset components, assembly services and other products dropped 4.8% to 41 billion yuan, BYD said.

Chinese Premier Li Keqiang toured BYD’s headquarters in Shenzhen earlier in August and vowed to boost already growing sales of electric cars and keep preferential policies in place. China is the world’s biggest EV market.

BYD could deliver 1.5 to 2 million vehicles this year as capacity expands to meet a backlog of orders, according to Bloomberg Intelligence analysts Steve Man and Joanna Chen. “Higher selling prices and greater production scale should lift profitability,” they wrote in a research note dated Aug. 8.

The company is expanding overseas, announcing sales in seven new markets in recent months, including Japan, Thailand and Germany.

Shares are down about 1% this year, but wild swings in EV stocks mean BYD has fallen as much as 37% and climbed as much as 24% in the period. Earlier in the year, BYD overtook Volkswagen AG as the world’s third most valuable automaker, behind Toyota Motor Corp. and Tesla Inc.

BYD’s July New Energy Vehicle Sales More Than Triple to Record

Much of the movement stem from a stake matching the size of Berkshire Hathaway Inc.’s position in BYD appearing in Hong Kong’s stock market clearing system. Shares must enter the system before transactions can be settled, so are after often seen as a precursor to sales. Buffett’s Berkshire Hathaway hasn’t commented on the matter.

(Updates with comment from company in filing.)

©2022 Bloomberg L.P.