Mar 21, 2022

China Cabinet Vows Stronger Monetary Policy Support for Economy

, Bloomberg News

(Bloomberg) -- China’s cabinet pledged stronger monetary policy support for the economy while cautioning against flooding the market with liquidity, state broadcaster CCTV reported late Monday.

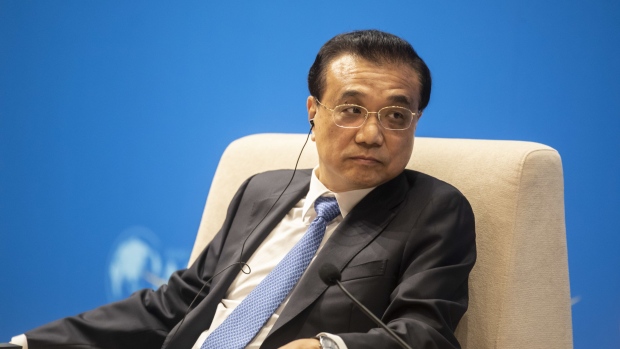

In a State Council meeting chaired by Premier Li Keqiang, the cabinet called for adoption of monetary policy tools to sustain credit expansion at a stable pace. The authorities also promised to maintain policies that can support the economy, while pledging to avoid measures that can hurt market sentiment.

The statement came as Chinese banks left borrowing costs unchanged early Monday, even as some market participants had expected a cut following a strong vow from Vice Premier Liu He last week to support growth. The one and five-year loan prime rates were kept unchanged at 3.7% and 4.6% respectively, according to the People’s Bank of China.

Read: China’s Banks Keep Lending Rate Unchanged Amid Easing Calls

The cabinet also said it’s important to monitor how international developments can affect the domestic capital market. Some 1 trillion yuan ($157 billion) of tax refund for smaller firms was also announced.

China’s economy has come under mounting pressure since late 2021, with a persistent housing market slump and the latest wave of Covid-19 outbreak hurting domestic demand.

One monetary policy action expected by economists is a reduction in the reserve requirement ratio. The PBOC lowered the ratio in July and December for most banks last year, with both of the cuts first signaled by the premier or the cabinet days in advance. However, there was also an instance in 2020 where the central bank chose not to act in the end act even after the State Council mentioned the policy tool. The Monday statement didn’t have a specific reference to the RRR when mentioning monetary policy tools.

©2022 Bloomberg L.P.