Dec 21, 2022

China Developers’ Recovery After $74 Billion Rout Faces Covid Turmoil

, Bloomberg News

(Bloomberg) -- Despite a disastrous year for China’s property sector, markets turned from extreme pessimism to euphoria in just a matter of weeks thanks to Beijing’s policy bazooka. Now there are growing signs the rally is faltering.

Real estate shares have entered a technical correction after a runup of 88% over the six weeks through early December. Weak homebuyer confidence and an uncertain economic recovery are threatening to outweigh policy support measures, including expanding a key bond-financing program to private developers and lifting a ban on equity refinancing.

“You can’t put all the money in right now because Covid needs to work its way through, and we have to wait for an economic recovery,” which may not happen until the second half of next year, said Thu Ha Chow, head of Asian fixed income at Robeco Group.

With the prospect of China reopening and the slew of support measures, including the initiation of a 16-point plan, shares have rebounded more than 60% since November. News that regulators would allow qualified developers to secure backdoor listings and support dealmaking this week also helped boost sentiment, with a gauge of developer shares up as much as 3.5% on Thursday.

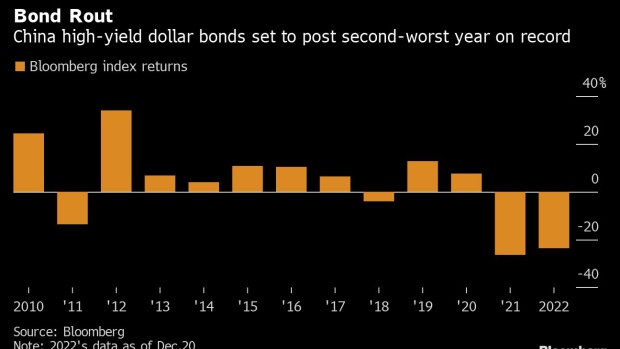

An index of high-yield dollar bonds dominated by developers’ has also jumped more than 30% — though that still leaves the sector on track to post its second-worst year on record.

Rattled by slumping housing demand and a record wave of defaults, a total of $74 billion in market value was wiped out this year in Chinese property stocks and bonds, according to calculations based on Bloomberg indexes. Shares had briefly plunged to the lowest level in 11 years.

Economic Weakness

While the market’s recovery hinges on a comeback of physical demand, that prospect is likely to be dampened as the impact of China’s messy pivot away from Covid Zero ripples through the economy. Analysts have made sharp revisions to their forecasts of China’s GDP growth next year, with some seeing the economy growing by below 3%.

Developers’ contracted sales could decline more next year thanks to Covid and depleted landbanks. Citigroup Inc. analysts including Griffin Chan expect sales to fall 25% in 2023, as recovery will be constrained by lower new supply, and buyers’ expectations will take time to turn around.

Investors are expecting further easing policies to shore up housing demand, though there are limits to how far those policies can go given Beijing’s recent reiteration that “housing is for living in, not for speculation” and broader economic weakness.

Jefferies Financial Group Inc. analyst Shujin Chen expects authorities to loosen purchasing restrictions again in high-tier cities and lower the down-payment ratio, adding that there’s a high chance of a cut in the five-year loan prime rate in the next two months.

The cash crunch at private developers also hasn’t been resolved. A recent flurry of share placements and stake sales in property management units suggests liquidity remains tight, and debt-saddled builders will have to increasingly rely on bank loans for funding as the offshore credit market gets too expensive.

Large-scale restructurings are also looming for the ranks of defaulted developers as they face creditor meetings, court appearances or the threat of liquidation, with China Evergrande Group expected to disclose a debt plan by the end of the year.

Winners and Losers

After nearly two years of trouble, 2023 is likely to see a shakeout in the Chinese property sector that will help identify winners and losers.

“Overall I do believe there is a positive turn, but it will play out in what you would call a survivor trade,” said Neeraj Seth, head of Asian credit at BlackRock Inc.

Lending support will likely be directed toward financially stronger developers. Meanwhile, state-owned developers are poised to gain market share as industry consolidation accelerates, with some private developers going bankrupt or facing liquidation, said Jian Shi Cortesi, investment director at GAM Investment Management.

Shares of state-owned developers, such as China Overseas Land & Investment Ltd. and China Resources Land Ltd., have posted single-digit gains this year, while private developers like Country Garden Holdings Co. and CIFI Holdings Group Co. have fallen at least 60%. Property management firms linked to builders with healthier balance sheets, such as China Resources Mixc Lifestyle Services Ltd., have also fared better than the broader sector.

Meanwhile, credit investors are closely monitoring developers’ liquidity situation as they try to identify the survivors of China’s sprawling debt crisis. A key thing to watch is when the rally will translate into significantly lower borrowing costs.

Seth cautioned that any recovery is likely to take time.

“If a patient who has been in the hospital for 18 months suddenly gets the right medicine, it still takes time for them to recover,” he said. “The property sector has been suffering for 18 months, it’s not going to change course in one month.”

(Updates with further measures and prices in fourth graph)

©2022 Bloomberg L.P.