Mar 26, 2024

China Files WTO Complaint Over US Electric-Vehicle Subsidies

, Bloomberg News

(Bloomberg) -- China is taking its dispute with the US over electric-vehicle subsidies to the World Trade Organization, challenging elements of President Joe Biden’s signature climate law passed in 2022.

The Inflation Reduction Act and associated rules are “discriminatory” and have “seriously distorted” the global EV supply chain, the Chinese Ministry of Commerce said in a statement Tuesday announcing a complaint it’s filed to the WTO.

The US’s top trade official, Ambassador Katherine Tai, responded that China continues to use “unfair” policies and practices to undermine fair competition and dominate global markets.

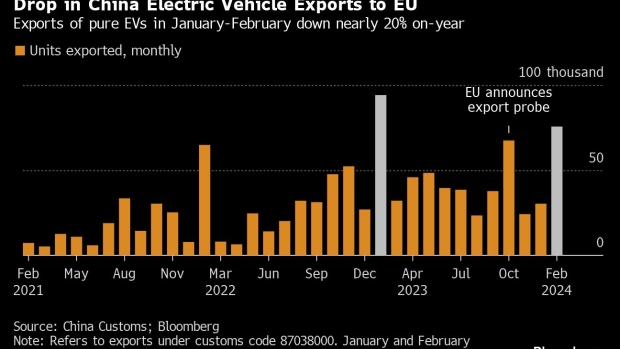

The EV sector has increasingly been caught up in tensions over trade and geopolitics as the world transitions away from the internal combustion engine. The European Union is likely to impose additional tariffs on EVs imported from China due to accusations of unfair subsidies, while world-leading Chinese battery firms have run into resistance from Washington.

The complaint comes months after the US finalized restrictions that reduced the number of electric cars eligible for as much as $7,500 purchase tax credits. The guidelines that went into effect beginning this year will eventually mean that vehicles containing battery components or raw materials sourced from “foreign entities of concern” will no longer qualify for credits.

“I would not assume this case is automatically a winner for China,” said Bill Reinsch, a senior adviser at the Center for Strategic and International Studies. “Procurement and subsidy rules are complicated, and I can see the US putting up a strong defense.”

Read More: Biden’s EV Dreams Complicate Life for US Carmakers

Under guidelines the Biden administration released late last year, any company that is subject to the jurisdiction of China’s government, or is controlled by the government — including if it’s at least 25% owned by a Chinese government authority — is considered an FEOC. The restrictions also apply to all production inside of China.

However, foreign subsidiaries of privately owned Chinese companies in non-FEOC countries, such as Australia or Indonesia, will be allowed so long as they’re not controlled by the Chinese government.

“Legally speaking, China does have a point in that the IRA does violate WTO rules, a point that the EU also made,” said Henry Gao, a law professor at Singapore Management University who researches Chinese trade policy.

Read More: Why Europe Fumed Over Biden’s Green Subsidies

Gao noted that President Xi Jinping recently praised China’s efforts to promote the global energy transition, saying that China should push for the establishment of a fair, just, balanced and inclusive global energy governance system.

“With such explicit political exhortation, I would have been really surprised if the Ministry of Commerce did not follow up with a WTO complaint,” Gao said. “Xi is essentially throwing the gauntlet with a formal WTO case, trying to deter whoever wins the election later this year not to continue the same. But I don’t think it will work as being tough on China has become the consensus of both parties.”

The lawsuit is unlikely to force the US to change policy, according to Brad Setser, a former official at the US Trade Representative. In a thread on X, he predicted that the Chinese case will be “appealed into the void.”

China has nurtured its domestic EV industry with a series of tax breaks, production and purchase subsidies and state-supported research and development over decades.

The government effectively excluded foreign battery manufacturers from the market for a time when the industry was still developing, creating a “whitelist” of approved battery makers that could supply local EV manufacturers. The list, which was abolished in 2019, was comprised entirely of Chinese firms, S&P Global Market Intelligence said in a report late that year.

(Updates with comment from top US trade official in the third paragraph.)

©2024 Bloomberg L.P.