Nov 4, 2019

China Halts Massive Bond Rout With Symbolic Interest Rate Cut

, Bloomberg News

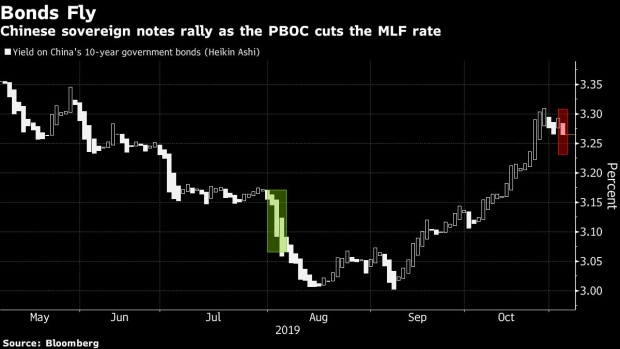

(Bloomberg) -- China’s central bank has finally helped put the brakes on the downward spiral in government debt.

While Tuesday’s 5 basis-point reduction in the cost of one-year loans to banks was largely symbolic, it was the first such move since 2016. That was enough to soothe nerves in a market that’s been walloped by the prospect of tighter liquidity in the financial system.

The relief was apparent: China’s benchmark 10-year yield dropped the most since August, while the cost on 12-month interest rate swaps fell the most in a month. But skeptics say the reduction doesn’t represent a direct cut in borrowing costs to the economy, showing Beijing is sticking to its prudent approach to stimulus amid a spike in inflation.

“It’s only a little bit of comfort,” said Hao Zhou, senior emerging markets economist at Commerzbank AG. “It doesn’t mean the party will resume. Bond traders will be still struggling to find a concrete answer between monetary policy actions and the inflation dynamics.”

The People’s Bank of China on Tuesday lent 400 billion yuan ($57 billion) with its medium-term lending facility and lowered the interest rate on the loans to 3.25% from 3.3%, according to a statement. The injection replaced 403.5 billion yuan of loans that mature.

--With assistance from Livia Yap.

To contact Bloomberg News staff for this story: Claire Che in Beijing at yche16@bloomberg.net

To contact the editors responsible for this story: Sofia Horta e Costa at shortaecosta@bloomberg.net, Fran Wang

©2019 Bloomberg L.P.