Aug 20, 2019

China Rate Reform Throws Focus on What’s Next to Aid Economy

, Bloomberg News

(Bloomberg) -- The People’s Bank of China unveiled a major reform to its system of benchmark interest rates on Tuesday, a move that’s immediately focused attention on if and when the real monetary easing will begin.

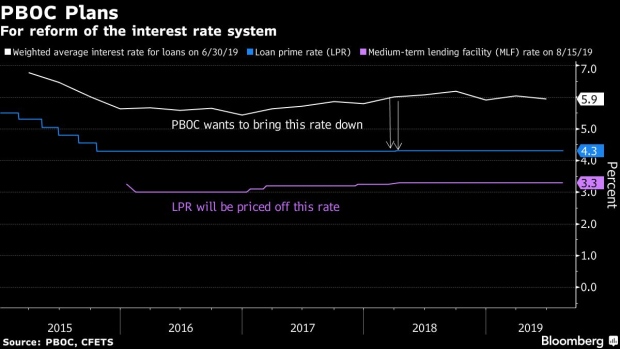

The central bank will now release a so-called Loan Prime Rate each month, a yardstick meant to peg the cost of borrowing by firms and households more closely to the rates that banks pay for cash in money markets. While that step itself should already nudge borrowing costs a few basis points lower, analysts say that outright cuts to monetary policy tools are still needed.

Even though China’s economy is slowing to its weakest pace in almost thirty years, the government remains focused on stability rather than speed amid the broadening confrontation with the U.S. That means PBOC officials are sounding reluctant to roll out the big stimulus guns: monetary-policy department head Sun Guofeng said Tuesday that there’s “not too much” room to further cut banks’ reserve ratios.

“The reform tells markets that the PBOC isn’t keen to cut reserve ratios or interest rates immediately,” said Peiqian Liu, China economist at Natwest Markets in Singapore. “The central bank is paying more attention to rates transmission, which will be the focus in the second half of the year.”

Industrial output slid in July, after second quarter gross domestic product growth came in at the weakest pace since quarterly data began in 1992. For some, the current approach isn’t enough to arrest the economy’s slide and adjustments to some of the PBOC’s tools are in view.

The interest rate reform itself means the PBOC is less likely to use its old benchmark lending rate to cut costs broadly across the economy, as policy makers have said that instrument will ultimately be scrapped. The new lending rate was announced at 4.25% on Tuesday, 10 basis points lower than the old benchmark.

Instead, analysts are focusing on the medium-term lending rate and bank reserve ratios as possible tools to be adjusted.

Sun steered against outsize expectations in that department.

“There is some room for adjustment to the reserve-requirement ratios, but generally speaking the room isn’t as big as people imagine,” Sun said Tuesday.

Liu said the central bank will likely keep monetary policy stable in the third quarter, and it’s likely to lower the rate for mid-term lending toward the end of the year by 5-10 basis points.

The central bank under Governor Yi Gang has become increasingly wary of flooding the economy with cash even as it slows because of concerns about property market bubbles and financial stability risks. That stance has held even as the impact of the trade war with the U.S. has worsened.

The LPR reform is to “improve the formation and transmission of interest rates,” it can’t replace monetary policy or other policies, Sun Guoefeng said Tuesday. The PBOC will work with relevant departments to take various measures to lower overall borrowing costs, he said.

Fiscal policy makers are stepping up with support for the economy while monetary policy appears constrained. The government is considering allowing provincial governments to issue more bonds for infrastructure investment, raising the quota from the current level of 2.15 trillion yuan ($305 billion), according to people familiar with the matter.

However, expectations for further action from the PBOC still remain.

“Considering the State Council’s aim to reduce funding costs for smaller companies by another 100 bps this year, we expect the PBOC to reduce rates for its medium-term lending facilities by 25-50 basis points by year-end,” Bloomberg Economist David Qu wrote in a note. “We see further room for the LPR to decline in the coming months, aided by other policy easing measures.”

“As the transmission channel will to some extent be improved, the PBOC may be more willing to cut quasi policy rates to drive down the LPR,” Lu Ting, chief China economist at Nomura International in Hong Kong wrote in a note. “We expect riskless rates and government bond yields to drop further as the PBOC catches up with other central banks in rate cutting.”

To contact the reporters on this story: Jeffrey Black in Hong Kong at jblack25@bloomberg.net;Yinan Zhao in Beijing at yzhao300@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, James Mayger

©2019 Bloomberg L.P.