Sep 29, 2021

China’s Coal Frenzy Has Commodity Freight Zooming Higher

, Bloomberg News

(Bloomberg) -- China’s energy crisis has sent shipping costs spiraling as the Asian country snaps up coal to keep powering its economy this winter.

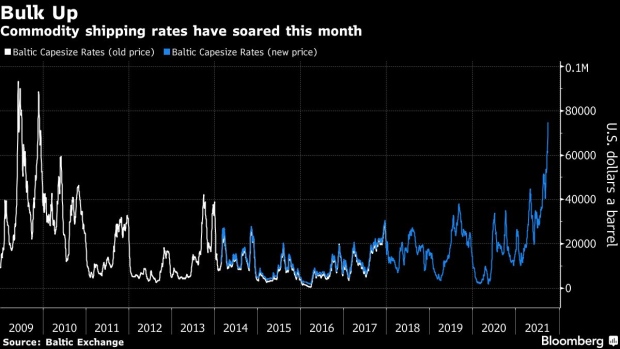

Giant capesize commodity carriers -- used to haul coal -- are now earning almost $75,000 a day, the most since 2009. Those earnings are up more than 50% so far this month as a scramble to procure coal for power generation coincides with already-strong demand for industrial commodities.

China needs more fuel cargoes to fire its economy and it faces increased competition from Europe where there are concerns about gas supply. On Monday, Goldman Sachs Group Inc. cut its 2021 and 2022 economic growth forecast for the Asian country, saying recent sharp cuts to production in a range of high-energy-intensity industries add to significant downside pressures on the outlook.

“There is so much demand at the moment, it’s both coal and iron ore,” said Ulrik Andersen, chief executive officer of Golden Ocean Group, which owns 56 capesize freighters. “We see a very, very strong market that is well reflected in rates that are going up. As we see it right now we don’t see why it wouldn’t continue for at least this week.”

Last week, a Chinese state energy newspaper said that the country’s power generators are prioritizing procuring enough coal at the moment and are willing to pay whatever the freight costs. The dry bulk market was already moving from strength to strength as demand for raw materials recovers with economic growth after the depths of the pandemic.

As power and gas prices hit record highs, coal is making a resurgence in powering the world’s electricity grids. European coal has risen to a 13-year high and Newcastle coal has more than tripled over the past year.

The Baltic Dry Index, which measures earnings for bulk commodity shipping is nearing 5,000 points, the highest level since 2008.

And with rates now at their strongest in more than a decade, there’s also little reason to think they’ll go back to normal levels soon. Forward contracts have also been rallying in recent days with earnings for the fourth quarter topping $50,000 a day Wednesday. That suggests elevated rates will be around for the rest of the year.

“Coal volumes keep driving the dry bulk segments,” Pareto analysts Eirik Haavaldsen and August Klemp wrote in a note to clients. “All markets are just tremendously tight now.”

©2021 Bloomberg L.P.