Jan 30, 2023

China’s Economic Activity Rebounds Sharply After Reopening

, Bloomberg News

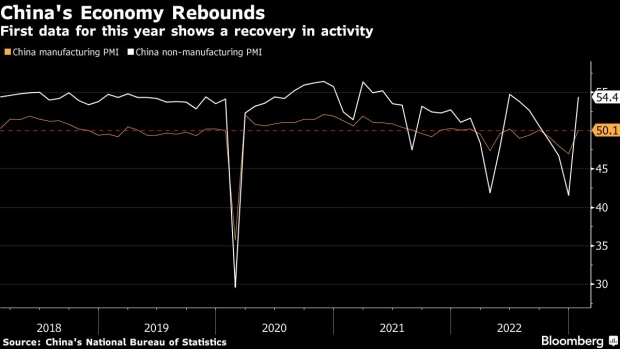

(Bloomberg) -- China’s manufacturing and services expanded for the first time in four months in January as the reopening from Covid Zero continued and the Lunar New Year holiday spurred travel and spending.

The manufacturing purchasing managers’ index rose to 50.1 from 47 in December, matching economists’ estimates, the National Bureau of Statistics said Tuesday. The non-manufacturing gauge — which measures activity in both the services and construction sectors — increased to 54.4 from 41.6, topping expectations for 52 in a Bloomberg survey of economists.

Numbers above 50 represent an expansion, while anything below indicates contraction.

January’s activity improvements are welcome news for the world economy, which is cooling and and will rely in part on China’s recovery in 2023 to offset other risks. The International Monetary Fund on Tuesday raised its global economic growth outlook to 2.9%, the first increase in a year, alongside an upgrade to China’s estimated expansion. It now expects Chinas economy to grow 5.2% in 2023.

Read More: IMF Raises World Economic Outlook for the First Time in a Year

Activity in China usually slows during the Spring Festival — which this year fell during the last full week in January — as businesses close for the holiday and people travel back to their hometowns to see family. This year, though, marked the first time that people could freely move around the country in years as China abandoned its tough Covid Zero rules in late 2022.

While holiday travel hasn’t yet recovered to pre-pandemic levels of 2019, recent data did show a surge in the number of trips made during the week. Tourist spots were swamped, while movie theaters were packed.

A sub-index measuring services activity alone jumped to 54 from 39.4, suggesting residents became more willing to travel and spend money during the holiday season after three years of stringent mobility rules. The employment sub-index for non-manufacturing improved to 46.7 from 42.9, the highest level in five months.

“The fast reopening in China has significantly helped the economy and particularly boosted the services sector,” said Zhou Hao, chief economist for Guotai Junan International Holdings. “The darkest hour is gone, and the market is ready to embrace a fast economic recovery in China.”

The CSI 300 Index erased earlier gains to trade lower mid-morning, while stock gauges in Hong Kong also fluctuated. The yuan traded offshore touched a session high of 6.7488 per US dollar after the PMI release. The yield on 10-year Chinese government bonds fell slightly to 2.91%.

What Bloomberg Economics Says ...

“China’s economy is back in action — and growing again. January’s PMIs showed variation by sector, with services roaring back with more force than manufacturing from the Covid setback. But given Lunar New Year holidays meant fewer working days, a reading narrowly in expansion was still a solid performance for the manufacturing sector.”

— Chang Shu and David Qu, economists

Read the full report here.

For manufacturing activity, a sub-gauge measuring suppliers’ delivery time improved to 47.6 in January from 40.1. That reflected shorter delays for logistics and transportation.

The pickup in the factory gauge “show that production and operation has improved,” Zhao Qinghe, senior statistician at the NBS, said in a statement accompanying the release.

There are still “many manufacturing and services firms that reported insufficient market demand in January, which is still the biggest problem faced by firms,” Zhao added. “The economy’s recovery foundation needs to be further solidified.”

Underscoring the amount of momentum China’s economy has to regain this year from last year’s slowdown, data released Tuesday showed that industrial profits fell 4% in 2022 compared to the year before. The figure for the full 12 months showed a deepening decline from the 3.6% drop in January-November.

“The manufacturing sector’s production index is still below 50 though because of holiday factors and people extending holidays, but industrial activity should gain traction in February,” according to Michelle Lam, greater China economist at Societe Generale SA. The data “is consistent with our view that the worst was over and the economy should stage a strong recovery starting in 1Q.”

While the median estimate for gross domestic product growth this year among economists surveyed by Bloomberg is 5.1% — higher than last year’s 3% expansion — the pace and strength of the recovery remain to be seen. Top leaders are likely pinning their hopes on a fast rebound in consumption and have vowed to make that a main driver of growth — especially as weakness in exports and the property sector are expected to drag on activity and demand.

Beijing will also have an opportunity to announce more stimulus to support growth when it unveils a the annual economic plan at the National People’s Congress in March.

--With assistance from Yujing Liu, Wenjin Lv, John Cheng and Jiyeun Lee.

(Updates to include economists’ reactions and more sub-indexes, along with global context, from paragraph four.)

©2023 Bloomberg L.P.